Validating VAT Registration Numbers

Determination provides a VAT validation servlet that communicates with the VAT Information Exchange System (VIES). To meet statutory requirements, you can use the VIES servlet to validate registration numbers for EU member countries.

You can upload registration numbers singly or in batches and receive a validation response for each number.

Results are verified according to the VIES registration data. The servlet does not validate VAT registration numbers against the Determination registration mask associated with a given authority in Determination.

When registration numbers are included in transactions, Determination validates the number against registration masks.

Submit registration numbers for validation

- Open a browser window.

-

Navigate to the URL http://<app_server>:<port>/sabrix-extensions/registrationvalidation. The <app_server>:<port> indicates the name and port of the application server hosting Determination.

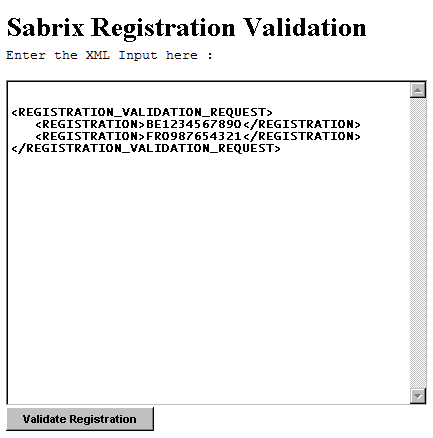

A page similar to the following opens:

- Enter <REGISTRATION> elements to represent the registration numbers, including the member country and registration number. You can enter a single registration number or multiple numbers, each on a separate line.

VIES Validation Input XML Elements

XML Field Name

Type

Description

<REGISTRATION_VALIDATION_REQUEST>

structure

<REGISTRATION>

string

VAT registration number, for example, BE1234567890

- Click Validate Registration to submit the registration numbers.

- After the XML is received and processed, the results are displayed, including messages. If name and address are part of the VIES registration record, they are also displayed.

VIES Validation Output XML Elements

XML Field Name

Type

Description

<REGISTRATION_VALIDATION_RESPONSE>

structure

<REGISTRATION_RESPONSE>

structure

<REGISTRATION>

string

VAT registration number

<MESSAGE>

string

VIES validation message

<NAME>

string

VAT registration name (optional)

<ADDRESS>

string

VAT registration address (optional)

<REQUEST_DATE>

string

When the request was received

You may receive an error message because of different time zones. The message in the response will be one of the following:

- Yes, valid VAT number.

- No, invalid VAT number.

- Service unavailable. Please re-submit your request later.

- Member State service unavailable. Please re-submit your request later.

- Error: Incomplete (VAT + Member State) or corrupted data input.

- Request time-out. Please re-submit your request later.

- Unexpected error. Could not communicate with VIES web service.