Bracket Tax System

In the United States, states may use different types of tax structures to impose tax on taxable sales. Many states round the tax amount to the nearest cent. This works for most states, but not all.

Alabama, Florida, and Maryland have a tax structure that includes a bracket system on taxable sales that cannot be calculated by simply rounding the amount.

Rules differ from state to state, but in general, a fee is applied to the fraction of a dollar (cents) of the taxable basis, in addition to the regular tax rate on whole dollar amounts. Based on the fraction of the dollar, a fee is applied according to the state's published graduated schedule. The total tax amount is calculated by adding the two tax amounts together.

You can record bracket transactions in the Audit database in the same way that you can record non-bracket transactions.

Who should use the Bracket Tax System?

Any business that has retail or ecommerce sales or a specialized business such as retail online sales should use the bracket system.

For each of the state bracket authorities, Determination provides rules for applying the correct tax, but does not tie any products to the rules. You will need to create your own custom product rules to make sure the bracket system only applies to the appropriate retail transactions.

When transactions are passed in to Determination via XML input, a tax code should be present in the data or implemented and applied to the appropriate transactions using a TransEditor. Standard tax fees, rules and rule qualifiers are triggered that indicate the bracket system should be used in tax calculations.

Turning on the Bracket Authorities

The US Bracket Authorities are included when you download current tax data content. The authorities are turned off by default. The user with the role of Tax Data Administrator will need to turn the bracket system on for each company that is doing business in a bracket jurisdiction. (If you have not been assigned the role of Tax Data Administrator, you must obtain it before you can turn on the authorities.)

After you turn on the bracket authorities, bracket results are returned for any transaction in that jurisdiction. That means that a company that includes both retail (brick and mortar and ecommerce) as well as manufacturing-type transactions will be taxed at the bracket tax system rate.

If you do not want all your transactions to be processed under the bracket system, you can use specific data elements (for example, tax code or product code) to trigger only the rules that apply for the bracket authority. If you decide not to set up custom rules to apply bracket results to only certain transactions, all retail as well as non-retail transactions will receive the bracket tax results.

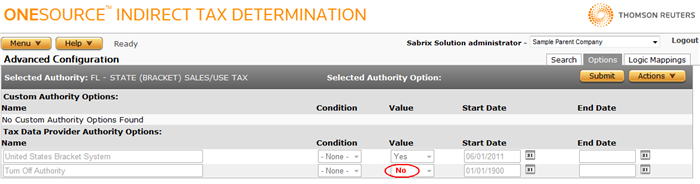

The authorities are enabled on the Advanced Authority Options page.

Enabling a bracket authority

Please contact Customer Support for assistance when turning on a bracket authority.

- Verify that you have the role of Tax Data Administrator.

- Select Menu > Tax Data > Authorities > Advanced Configuration > Options.

- Select one of the states that uses the bracket system, such as the FL - STATE (BRACKET) SALES/USE TAX authority.

-

The Turn Off Authority option is set to Yes by default. Think of the option as asking if you want to turn off the authority. To enable the bracket authority, set to No (as in, "No, please turn the authority on.").

- Click Submit to save your results.

Bracket System Examples

Florida, Alabama, and Maryland are the only states that use a bracket tax system.

Note that in the examples, the taxable basis is understood to be the gross amount minus any exemptions (or other deductions).

Florida

Florida has a bracket for state sales tax as well as several brackets of combined state and local rates. The taxing authority determines the appropriate bracket to use, according to the percentage of discretionary sales surtax to apply.

If Determination identifies a transaction taxable basis to include when applying a combined rate as specified by the taxing authority, the whole dollar amount is taxed at the combined rate (of which 6% is the state tax and the remainder is the discretionary sales surtax paid to a local authority). The cents is evaluated against the state bracket, and the result is then added to the state tax amount.

Schedules for combined rates (provided by the state) indicate the percentage allocated to general sales state tax and to a discretionary sales surtax rate.

|

Transaction Details |

Amount |

||

|---|---|---|---|

|

Example 1. Combined Rate 6.5% (6% is general sales tax and .5% is discretionary sales surtax) |

|||

|

Total transaction gross amount These authorities are involved:

|

$750.50 |

||

|

Whole dollar portion * 6% state sales tax |

$750.00 * 6.0% = $ 45.00 |

||

|

Whole dollar portion * .5% discretionary sales surtax |

$750.00 * 0.5% = $ 3.75 |

||

|

Cents (referenced against bracket schedule) |

$ 0.50 = $ 0.04 |

||

|

In this example, $45.04 is paid to the state (state + bracket); $3.75 to the Orange County authority. |

|||

|

Example 2. Combined Rate 7.5% (6% is general sales tax and 1.5% is discretionary sales surtax) |

|||

|

Total transaction includes six different retail items:

These authorities are involved:

|

$ 123.43 |

||

|

Tax Rate |

Item A |

Items B and C |

Items D, E, and F |

|

Whole dollar portion * 6% state sales tax |

$4.00 * 6% = $0.24 |

$1.00 * 6% = $0.06 |

$38.00 * 6% = $2.28 |

|

Whole dollar portion * 1.5% discretionary sales tax |

$4.00 * 1.5% = $0.06 |

$1.00 * 1.5% = $0.02 |

$116.00 * 1.5% = $.57 |

|

Cents referenced against bracket schedule |

$0.24 = $0.02 |

$0.11 = $0.01 |

$0.99 = $0.08 |

|

Total tax per item |

$0.32 |

$ 0.09 |

$ 2.93 |

|

Total tax = Item A ($0.32) + Items B and C ($0.18) Items D, E, and F ($8.79) = $9.29. In this example, $7.48 is paid to the state (state + bracket); $1.81 to the Escambia County authority. |

|||

Alabama

In transactions where the combined tax rate is higher than the 4% state general rate, standard rounding rules are applied. For more information about rounding rules, see Rounding Rules.

The 4% combined rate is applicable to state-only transactions, but is also applicable in reduced rate scenarios where the Agricultural or Manufacturing rates apply.

In transactions where only the 4% Alabama state general tax rate applies, the whole dollar amount is taxed at the 4% rate, and the cents are taxed according to the bracket schedule (according to the Alabama Tax Rate Chart). The two amounts are added together to derive the total tax amount.

|

Transaction Details |

Amount |

|---|---|

|

Total transaction amount These authorities are involved:

|

$ 45.55 |

|

Whole dollar portion * rate |

$45.00 * 4% = $ 1.80 |

|

Cents (referenced against bracket schedule) |

$ 0.55 = $ 0.03 |

|

Total tax |

$ 1.83 |

Maryland

Maryland requires the 6% standard rate in order for the bracket to be applied. Calculation logic for Maryland evaluates both the combined rate and the taxable basis.

Two bracket groups apply in Maryland, depending on the amount of taxable sales:

- For sales where the taxable basis is less than or equal to $1.00, the tax is assessed according to the graduated bracket schedule.

- For sales where the taxable basis exceeds $1.00, the 6% general sales tax applies to whole dollar amounts, plus an amount derived from the graduated bracket schedule calculated on the remaining cents. The two amounts are added together to derive the total tax amount.

|

Transaction Details |

Amount |

|---|---|

|

Total transaction amount These authorities are involved:

|

$ 751.24 |

|

Whole dollar portion * rate |

$751.00 * 6% = $ 45.06 |

|

Cents above $1 (referenced against bracket schedule) |

$ 0.24 = $ 0.02 |

|

Total tax |

$ 45.08 |