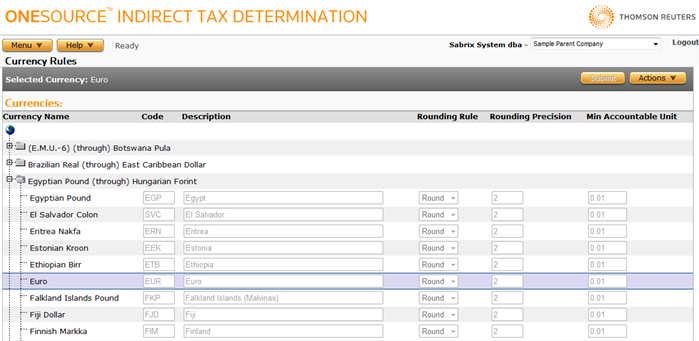

Currency Rules

Menu > Tax Data > Currencies > Currency Rules

Use this page to view currencies, including their rounding and precision rules.

Before using this page for the first time, please review Currencies.

When a transaction is submitted to ONESOURCE Indirect Tax Determination, a currency is attached to it. Different currencies have different rounding rules and different precisions. For example, Japanese yen is not rounded to the hundredth as is the US dollar. In some countries, currency values are truncated instead of rounding them to the specified precision.

Determination Currency Rules can be overridden, and exchange rate conversion rules specified, at the Company or Authority level.

For more information about rounding, see Rounding Rules.

|

Currency Rules Field Reference |

|

|---|---|

|

Currency Name |

The name of the currency. Use the expandable/collapsible list to find the desired currency. |

|

Code |

The code used to refer to the currency in the Input XML data. |

|

Description |

The description of the currency. |

|

Rounding Rule |

The rounding rule: Round, Floor, or Ceiling. For more information, see Rounding Rules. Required. |

|

Rounding Precision |

The number of decimal places included. For example, 2 means that 4.05 would be precise, and that 4.053 would be rounded to 4.05. You can enter up to ten digits. |

|

Min Accountable Unit |

The minimum accounting unit. For example, in some countries the currency only supports increments of 1/20th of a whole unit – in this case, the minimum accounting unit is .05. |