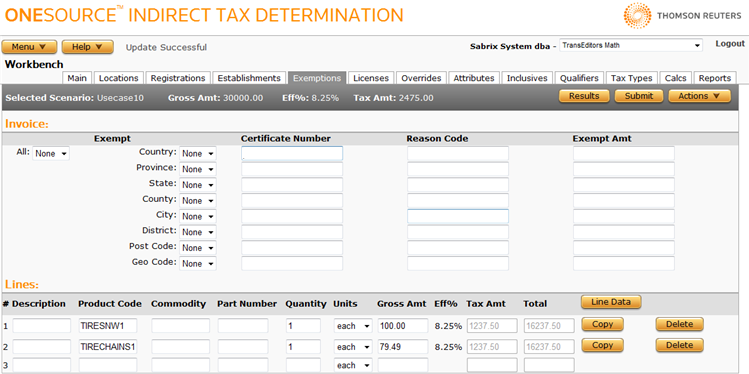

Workbench Exemptions

Menu > Workbench > Exemptions

Use this page to enter exemption data for different effective tax levels in a transaction. You can exempt all transactions, or limit their application based on amounts, certificate numbers, or exempt reasons, on both the invoice or line level.

For example, you can specify that if a calculation results in a tax effective at the City level (such as IL – Chicago City Sales/Use), you can exempt $500 of that transaction.

Add an invoice-level exemption

- Choose whether or not to exempt all taxes at all levels by selecting Yes or No (default) from the All menu.

- If you selected No, you can specify in which zone levels you want to add the exemptions. Choose Yes, No, or None at each level.

- If you choose Yes for any level, the entire amount is exempted.

- If you choose None, you can optionally limit the exemption to transactions passing specified Certificate Numbers, Reason Codes, or Exempt Amounts (see the field reference below).

- Click Submit to save this exemption.

Add a line-level exemption

- Click the Line Data button if necessary. This button does not appear if you are already in line configuration mode.

- Select the desired line by choosing a number from the Line menu. If you need to see details about a line, you can toggle back and forth by clicking the Line Items and Line Data buttons.

- Choose whether or not to exempt all taxes at all levels by selecting Yes or No (default) from the All menu.

- If you selected No, you can specify in which zone levels you want to add the exemptions. Choose Yes, No, or None at each level.

- If you choose Yes for any level, the entire amount is exempted.

- If you choose None, you can optionally limit the exemption to transactions passing specified Certificate Numbers, Reason Codes, or Exempt Amounts (see the field reference below).

- Click Submit to save this exemption.

View XML data

- Navigate to the Actions menu.

- Select XML Input, Allocated XML Input, Filtered XML Input, or XML Output. For more information, see Viewing Workbench XML Data.

Export a scenario

You can export the selected scenario, or all scenarios associated with this company

- Select Properties from the Actions menu.

- Click one of the following:

- This Scenario to export only the selected scenario.

- This Scenario and All Siblings to export the selected scenario and all other scenarios associated with the selected company.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

View calculation details

- Click Submit to save your scenario.

- Then click Results in the Selected Scenario section.

|

Workbench Exemptions Field Reference |

|

|---|---|

|

Certificate Number |

The exemption certificate's number. |

|

Reason Code |

A defined reason code used by the selling company. If a rule exists to handle the reason code then it can affect taxation. For more information on reason codes and rules, see Rules. |

|

Exempt Amt |

The amount of a line or invoice that is exempt from tax. |