Workbench Reports

Menu > Workbench > Reports

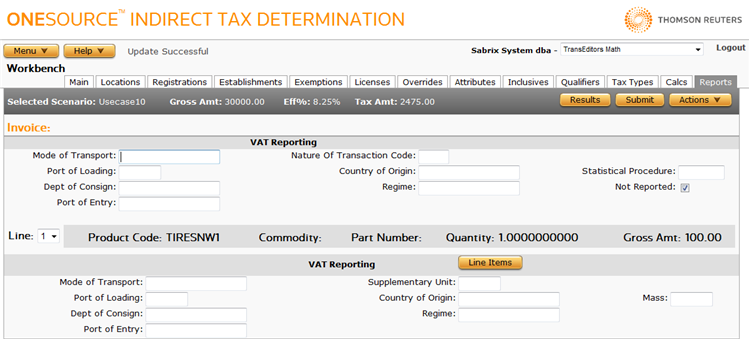

Use this page to specify data that is commonly stored for use in generating VAT reports in the European Union.

Set invoice-level options

- Enter or select the desired values.

- Click Submit to save the options.

Set line-level options

- Click the Line Data button if necessary. This button does not appear if you are already in line configuration mode.

- Select the desired line by choosing a number from the Line menu. If you need to see details about a line, you can toggle back and forth by clicking the Line Items and Line Data buttons.

- Enter or select the desired values.

- Click Submit to save the options.

View XML data

- Navigate to the Actions menu.

- Select XML Input, Allocated XML Input, Filtered XML Input, or XML Output. For more information, see Viewing Workbench XML Data.

Export a scenario

You can export the selected scenario, or all scenarios associated with this company

- Select Properties from the Actions menu.

- Click one of the following:

- This Scenario to export only the selected scenario.

- This Scenario and All Siblings to export the selected scenario and all other scenarios associated with the selected company.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

View calculation details

- Click Submit to save your scenario.

- Then click Results in the Selected Scenario section.

|

Workbench VAT Reports Field Reference |

|

|---|---|

|

Port of Loading |

The port or airport of departure. |

|

Dept of Consign |

Department of consignment. |

|

Port of Entry |

The port of entry. |

|

Mode of Transport |

The mode of transport. |

|

Country of Origin |

The origin country for the goods or services. |

|

Regime |

The Regime, used in French reporting. |

|

Nature of Transaction Code (Invoice Only) |

A required code for Intrastat reports. |

|

Statistical Procedure (Invoice Only) |

A statistical indicator used in large shipments. |

|

Not Reported

|

Controls whether the invoice being processed should be included in reports. An invoice can be included in the audit tables but restricted from appearing on VAT and other reports by checking this box. |

|

Supplementary Unit (Line Only) |

The size of a supply. For Intrastat reports in the EU, some commodities require an additional measuring unit other than or in addition to mass for reporting purposes. EU rules determine the unit to be used for various supplies. |

|

Mass (Line Only) |

The mass of a supply. |