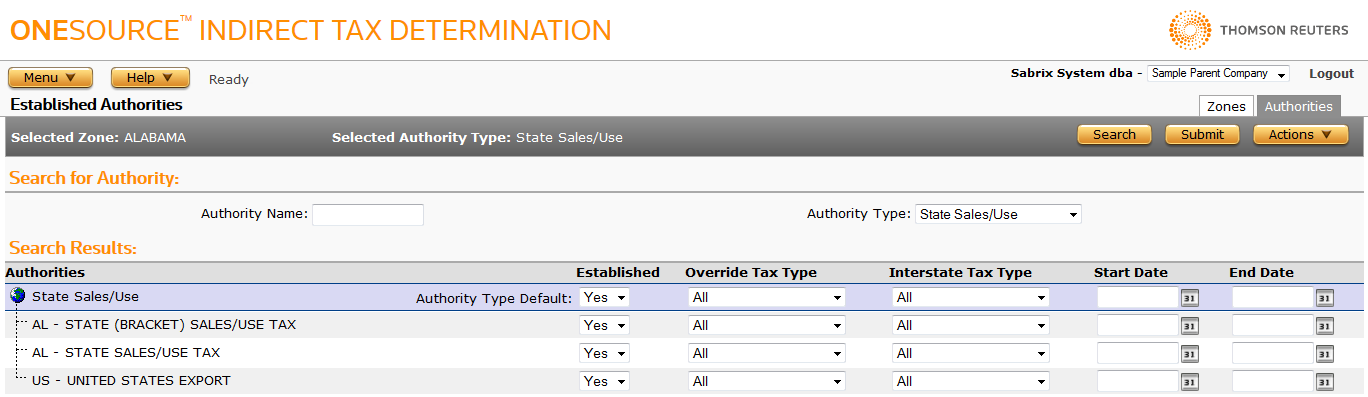

Authorities for Established Authorities

Menu > Company Data > Established Authorities > Authorities

Use the Established Authorities page to specify the locations in which your company is established—resulting in tax reporting obligations. On the Authorities tab, you can customize your company's establishment settings within a selected zone.

Before using this page for the first time, please review Establishments.

Throughout Determination, custom authorities are indicated with blue, underlined, italic text.

Changing an establishment setting at one level clears any explicit establishment settings below that level. For example, if you change Default Established for Arizona from Yes to None, all preexisting establishment settings for authority types and authorities within Arizona will be removed.

Be sure to configure establishments in order from most general to most precise. See Understanding the Establishment Settings Hierarchy for more information.

When you set an effective date range using the start date and/or the end date, that range is relative to the Established setting. See Configuring Effective Date Ranges for Establishment Settings for more information.

You can perform any of the following actions before clicking Submit:

Display a group of authorities

- Click the arrow on the Authority Type drop-down list.

- Select an Authority Type from the drop-down list.

Search for a particular authority

- Click the arrow on the Authority Type drop-down list.

- Select an Authority Type from the drop-down list.

- Enter a search string in the Authority Name field.

- Click the Search button.

Configure the establishment settings for your company in all authorities of a specific type

- Click the arrow on the Authority Type drop-down list.

- Select an Authority Type from the drop-down list.

- In the Authority Type Default row, make the following selections:

- In the Established drop-down list, select All to enable establishments or None to disable establishments.

- Optional: To force an intrastate tax type override, select a value from the Override Tax Type drop-down list. If you leave this set to All, default tax type determination applies.

- Optional: To force an interstate tax type override, select a value from the Interstate Tax Type drop-down list. If you leave this set to All, default interstate tax type determination applies.

- In the Start Date field, enter a date or select a date using the date picker. You can leave this field blank to clear out start dates for all authorities.

- In the End Date field, enter a date or select a date using the date picker. You can leave this field blank to clear out end dates for all authorities.

- Click Submit.

Once you set your authority type defaults, you can customize individual authorities by selecting them from the authorities list.

Configure the establishment settings for your company in an individual authority

- Display the authority, either by searching for it as shown above or by navigating in the search results list.

- In the Established drop-down list, select All to enable the establishment or None to disable the establishment.

- Optional: To force an intrastate tax type override, select a value from the Override Tax Type drop-down list. If you leave this set to All, default tax type determination applies.

- Optional: To force an interstate tax type override, select a value from the Interstate Tax Type drop-down list. If you leave this set to All, default interstate tax type determination applies.

- In the Start Date field, enter a date or select a date using the date picker. You can leave this field blank to not specify a start date.

- In the End Date field, enter a date or select a date using the date picker. You can leave this field blank to not specify a start date.

- Click Submit.

You cannot export established zones and authorities from this page. You must return to the Zones tab.