Establishments

Establishments indicate the locations in which your company has a business presence and result in tax reporting obligations to the associated authorities. Your company may be established in an authority, it may be registered with an authority, or a combination of both.

By default, Determination treats companies as established for all authorities in the United States and not established for all authorities outside of the United States. You can override the default settings in several ways. See Understanding the Establishment Settings Hierarchy below for more information.

Sharing Establishment Settings Between Determination Companies

You can share US and/or International establishment settings between a company and its descendants using the Established Authorities Data Provider drop-down lists on the Company Tax Preferences page.

Understanding the Establishment Settings Hierarchy

Establishment settings can be managed at various levels. In order from most general to most precise, those levels are:

- System Defaults: Determination treats all US authorities as established and all International authorities as not established unless you change establishment settings at a more precise level. These defaults can be changed in system configuration. See Calculation Parameters for more information.

- Tax Data Type: Set establishment for all authorities within all zones for a tax data type, such as United States Tax Data.

- Zone: Set establishment for all authorities within a zone. For United States Tax Data, zone-level establishment is by state, and for International Tax Data, zone-level establishment is by country.

- Authority Type: Set establishment for a group of authorities of a particular type within a zone, such as all City Sales/Use authorities for the state of Washington.

- Authority: Set establishment for an individual authority, such as CA - STATE SALES/USE TAX.

Establishment settings at each level of precision inherit a default from their parent unless you override the default with an explicit configuration. For example, if you set Established to All for Alabama, every authority type and their authorities within Alabama are considered established. You could then set Authority Type Default Established to None for the State Sales/Use authority type. Now, all State Sales/Use type authorities within Alabama are considered not established while all other authorities within Alabama are considered established.

This table shows:

- Where each level of establishment setting can be managed in the user interface.

- The parent establishment setting that an establishment level inherits from.

|

Name |

Location |

Default Inherited From |

|---|---|---|

|

System Defaults |

N/A (see note below table) |

N/A |

|

Default Established for Tax Data Type |

Menu > |

System Defaults |

|

Established for Zone |

Menu > |

Default Established for Tax Data Type |

|

Established for Authority Type Default |

Menu > |

Established for Zone |

|

Established for Authority |

Menu > |

Established for Authority Type Default |

System defaults can be changed with the configuration parameters DEFAULT_IS_ESTABLISHED_TRUE_US and DEFAULT_IS_ESTABLISHED_TRUE_INTL. See Calculation Parameters for more information.

To simplify configuration, use more general levels for your most common establishment settings, then manage exceptions at more precise levels. For example, if you are established everywhere in the states of California and Nevada, set Default Established to None for United States Tax Data, then set Established to All for the California and Nevada zones.

Changing an establishment setting at one level clears any explicit establishment settings below that level. For example, if you change Default Established for Arizona from Yes to None, all preexisting establishment settings for authority types and authorities within Arizona will be removed.

Be sure to configure establishments in order from most general to most precise.

Configuring Effective Date Ranges for Establishment Settings

You can configure an effective date range for an establishment using the Start Date and End Date fields. These date fields are always available, but they only affect tax calculation when the establishment setting is an exception to its parent. For example, to use a Start Date with a zone whose Established setting is All, the Default Established for the Tax Data Type must be set to None.

Tips for Configuring Start and End Dates

- Start and end dates are optional. For any establishment setting, you can include a start date, an end date, both, or neither. An empty value for a Start Date means that the Established setting will take effect for any time period up until the end date. An empty value for an End Date means that the Established setting will take effect for any period after the start date. If both dates are empty, the Established setting will take effect for any date.

- Determination performs best when your configurations are exception-based. If you do not need start or end dates for establishments, it is best to leave those fields empty.

- If you need to set unique start or end dates for individual zones, start by setting Default Established to None for the relevant tax data type. This will turn off establishment for all authorities for that tax data type. Next, turn on establishments individually for each zone as needed, entering start and/or end dates if applicable.

- When you submit a change to zone-level defaults, the drop-down lists and date fields for individual zones are updated and the drop-down lists and date fields for the default are reset. If you plan to use start dates or end dates for individual zone establishments, you will need to know the Default Established setting. Make sure to note the setting you apply for future reference.

- If you need to use start or end dates on specific authority types or authorities, it is best to first turn off the establishment at the zone level. Then, turn on establishments for authority types and/or authorities as needed, entering start and/or end dates if applicable.

Example Configuration Procedure

The date is January 10, 2015. You must configure a newly created Determination company, Sample Co. A, which has been doing business in Arizona and Idaho for several years. Sample Co. A is opening a new store in California on March 12, 2015. You have not changed the system defaults, so Determination will treat all US authorities as established unless otherwise specified. Follow the steps below to configure Determination.

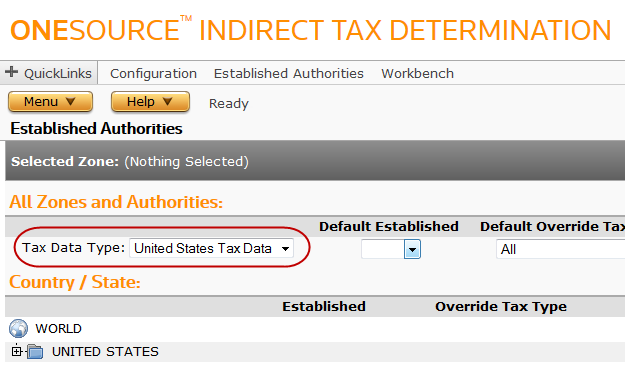

- Navigate to Menu > Company Data > Established Authorities.

- Ensure that the Tax Data Type is set to United States Tax Data.

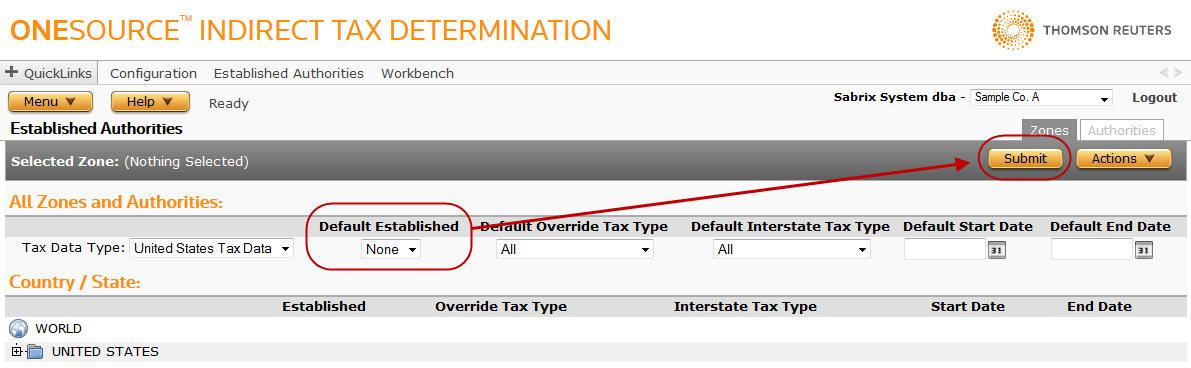

- Select None from the Default Established drop-down list, then click Submit. This turns off all establishments in the US.

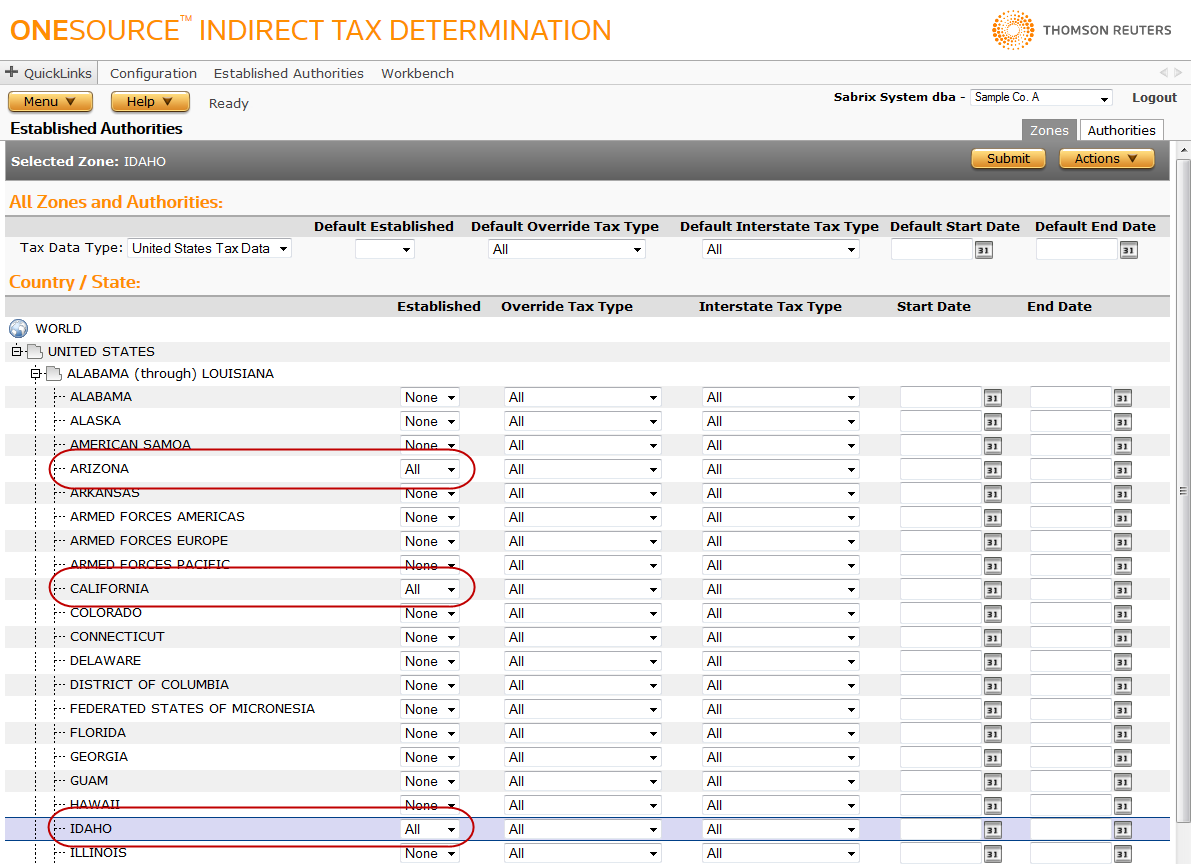

- In the Country / State section, click the plus sign next to UNITED STATES and then ALABAMA (through) LOUISIANA to display the first alphabetical group of zones.

- Select All from the Established drop-down list for Arizona, California, and Idaho.

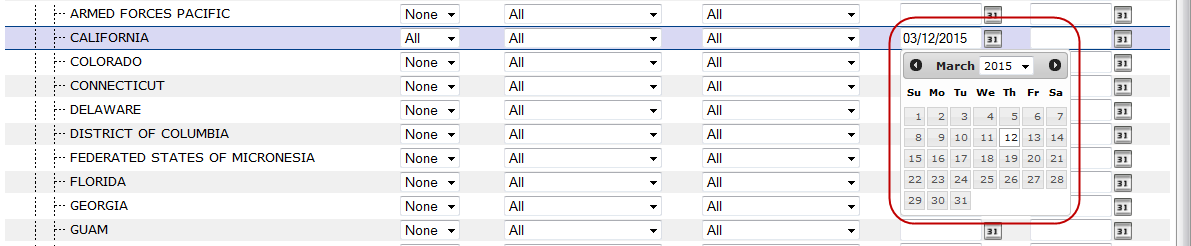

- Select March 12, 2015 from the Start Date date-picker for California.

- Click Submit.

Based on the settings configured above, Sample Co. A is:

- Established in Arizona and Idaho regardless of date.

- Established in California from March 12, 2015 forward.

- Not established in any other US states.

Adding dates to any of the US states that are set to None would have no effect because the Default Established is also None.

Example Date Configuration Applicability

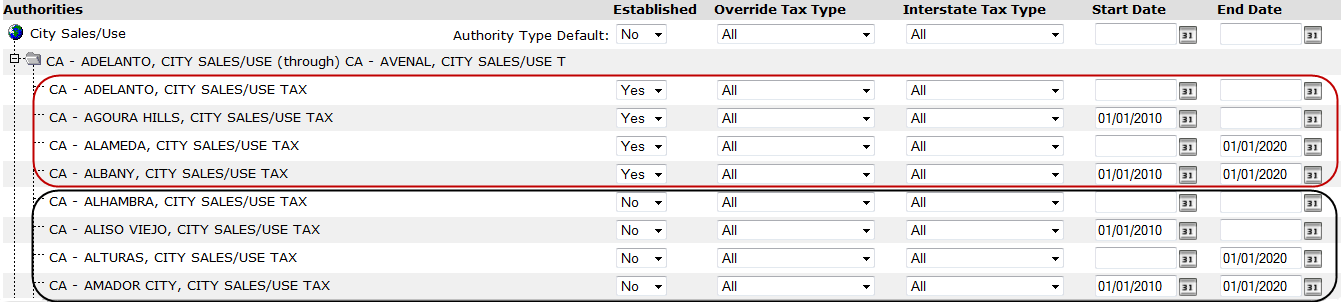

This screenshot and the explanation below illustrate how start and end dates are evaluated based on inheritance from parent establishment settings.

The following statements are true for the configuration shown above:

- Start and end dates will be evaluated for the four City Sales/Use authorities circled in red because the establishment setting is an exception to their parent, the Authority Type Default for City Sales/Use. Evaluation is as follows:

- CA - ADELANTO, CITY SALES/USE TAX is always established, regardless of the date.

- CA - AGOURA HILLS, CITY SALES/USE TAX is established from January 1, 2010 forward.

- CA - ALAMEDA, CITY SALES/USE TAX is established until December 31, 2019.

- CA - ALBANY, CITY SALES/USE TAX is established from January 1, 2010 through December 31, 2019.

- Start and end dates will not be evaluated for the four City Sales/Use authorities circled in black because the establishment setting is not an exception to their parent, the Authority Type Default for City Sales/Use.

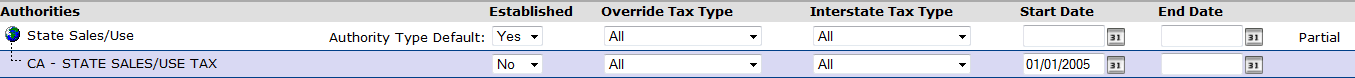

This screenshot and the explanation below illustrate how start and end dates are relative to their establishment setting.

For the configuration shown above, the CA - STATE SALES/USE TAX authority is established until January 1, 2005. The Start Date marks the beginning of the establishment setting of No. The date is evaluated because the establishment setting is an exception to its parent, the Authority Type Default for State Sales/Use.

Overriding a Tax Type

You can override tax types that apply to your establishments. For example, you can specify that interstate sales into New York should be subject to sales tax, and that interstate sales into New Mexico should be subject to use tax.

- For International Tax Data, force transactions to use a specific tax type by setting Override Tax Type.

- For United States Tax Data, force intrastate transactions to use a specific tax type by setting Override Tax Type, and force interstate transactions to use a specific tax type by setting Interstate Tax Type.

You can apply tax type overrides using any combination of establishment setting levels. For example, you can override interstate tax types for all zones in the United States Tax Data by setting Default Interstate Tax Type, and then configure all of California to use a different interstate tax type by setting Interstate Tax Type for the California zone.

Establishments Tasks

In Determination, you can:

- Set default established status for your company on the Configuration page. See Configuration.

- Configure establishments at the zone and authority levels on the Established Authorities Zones page. You can also set override or interstate tax types.

- Test establishment modifications on the Workbench Establishments page.

- Share established status with a related company on the Company Tax Preferences page.