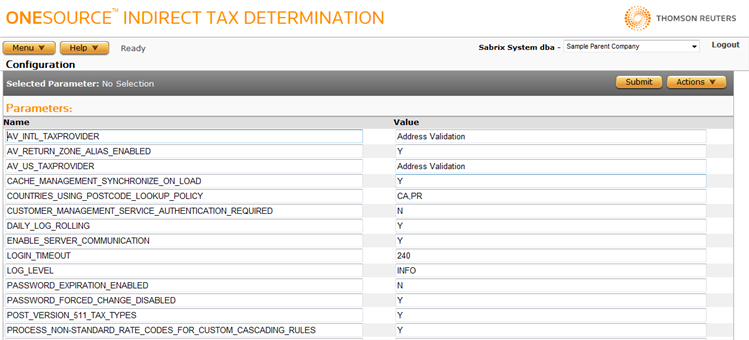

Configuration

Menu > System > Configuration

Configuration parameters are used in to determine how various application components should behave. Use this page to create and assign values to parameters.

Parameters specific to the Automatic Content Update are more easily viewed and set on the Configuration page. They include automatic tax data update functionality enabled by Import/Export.

Some configuration parameters may be set at the command line using a command line option. When a parameter is set in this way, it is listed on the Configuration page as a gray option and cannot be edited. For information on any parameter set this way, contact your system administrator.

The full list of parameters may assist Customer Support, when necessary.

Before making any Configuration modifications, please be sure that you have followed all instructions in the Installation Guide for your application server. Some configurations may not be valid if you have not applied the correct setup steps.

Managing Configuration Parameters

Use the following procedures to add, modify, delete or export parameters from your configuration.

- Select Add from the Actions menu. A new blank line appears.

- Enter the parameter name and value in the appropriate fields.

- Click Submit to save your changes.

- Edit the parameter's value.

- Click Submit to save your changes.

- Select the parameter by clicking on it.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

Export the selected parameter, or all parameters

- Select the desired parameter.

- Select Properties from the Actions menu.

- Click one of the following:

- This System Configuration Parameter to export only the selected parameter.

- This System Configuration Parameter and All Siblings to export all parameters.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

Parameters Set on the Configuration Page

Parameters that can be set on the Configuration page are:

Address Validation Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

AV_INTL_TAXPROVIDER |

Sabrix INTL Tax Data |

This parameter sets the Determination company used to look up zones when using the Address Validation servlet to look up non-US addresses. This can be any company set up in Determination, including both custom data provider and tax data provider companies. If this parameter is not configured, lookup is performed using INTL Tax Data. |

|

AV_PARTIAL_MATCH_STATES |

Null (Off) |

US territories and US armed forces addresses include "state" codes such as GU and VI (Guam and Virgin Islands) and AE, AP, and AA (US Armed Forces). If this parameter is set, submitting an address containing these codes can result in a successful zone tree match. Set to Code1, Code2, CodeN to enable validation for those "states." For example, set to AA,AE,AP,GU,VI. The default is null (off). |

|

AV_PLUS_FOUR_ALTERNATES_ENABLED |

Null (Off) |

Specifies whether the alternate +4 ZIP codes should be included in the return results when no +4 is supplied with a US address, or the supplied +4 is not found. Set to Y to enable the return of alternate +4s. The default is to not return alternate +4s. |

|

AV_US_TAXPROVIDER |

Sabrix US Tax Data |

This parameter sets the Determination company used to look up zones when using the Address Validation servlet to look up US addresses. This can be any company set up in Determination, including both custom data provider and tax data provider companies. If this parameter is not configured, lookup is performed using US Tax Data. |

|

COUNTRIES_USING_POSTCODE_LOOKUP_POLICY |

Null (Off) |

Set this parameter if you want Determination to evaluate postcodes and cities in countries other than the US. For example, if you are doing transactions in Puerto Rico and use <COUNTRY>PR</COUNTRY>, you would insert PR into this parameter. Note that this value is case-sensitive. If you want several countries to use this lookup policy, then separate each value with a comma. If you use both two and three character codes for a country, include each separated by a comma. This parameter uses Determination's default logic for postcodes and cities. For instance, if a city spans multiple counties, and no Zip +4 is provided, Determination selects the default city. If you decide to use this parameter, be sure that your source system supplies postcode data for the selected countries. This is also listed under "Calculation Parameters." |

|

SINGLE_ZONE_ALIAS_ENABLED |

Null (Off) |

Set this to the value of Y only if you want to turn off multiple zone alias processing. This is also listed under "Calculation Parameters." |

Audit Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

AUDIT_ADDRESSES |

Y |

Set to Y to enable writing of address data to the audit database. If set to any other value or Null, address data is not stored in audit. You must keep this value set to Y if you want to see addresses in ONESOURCE Indirect Tax Reporting. |

|

AUDIT_ALLOCATION_ACTIONS |

Null (Off) |

Set to Y to enable writing of allocation actions to the audit database. If set to any other value or Null (default), allocation actions are not stored in audit. |

|

AUDIT_AUTHORITY_ATTRIBUTES |

Null (Off) |

Set to Y to enable writing of authority attributes to the audit database. If set to any other value or Null (default), authority attributes are not stored in audit. In Determination, AUTHORITY_ATTRIBUTES are generated from the Rule Output as defined on the authority rule. Name and Value are entered for selected rules on the Rule Output pages for Rules and Cascading Rules. This information is returned in the XML Output. |

|

AUDIT_AUTHORITY_TYPES |

Null (Off) |

Set to Y to enable writing of authority types to the audit database. If set to any other value or Null (default), authority types are not stored in audit. |

|

AUDIT_END_USES |

Null (Off) |

Set to Y to enable writing of end use data to the audit database. If set to any other value or Null (default), end use data is not stored in audit. |

|

AUDIT_KEY_MODE |

0 |

Do not change this value from the default setting unless you have been directed to do so in the ONESOURCE Indirect Tax Determination Installation Guide or by Customer Support. This parameter determines which key is used by Determination to look up documents. Determination supports two audit keys to enable the lookup of audit records: HOST_SYSTEM or MERCHANT_ID There are two settings for AUDIT_KEY_MODE:

This is a global configuration parameter for all companies. You can set this value as a company option on the Options tab of the Companies page. AUDIT_KEY_MODE with a value of 1 (One) applies only if the Configuration Parameter PESSIMISTIC_AUDIT_DATA_SAVE is set to Y. |

|

AUDIT_LICENSES |

Null (Off) |

Set to Y to enable writing of licenses to the audit database. If set to any other value or Null (default), licenses are not stored in audit. |

|

AUDIT_MESSAGE_TYPE_<TYPE> |

Null (Off) |

Set to Y to enable writing of invoice calculation messages of various TYPEs to the audit database. If set to any other value or Null (default), messages are not stored in audit. The following parameters can be configured:

|

|

AUDIT_OVERWRITE_INVOICE_ON_UPDATE |

Null (Off) |

Set this parameter to Y to enable the replacement of an invoice in the audit database when the invoice is re-submitted. By default (if the parameter is set to N or is not present) Determination maintains the original invoice, a reversal of that invoice, and the new version of that invoice. |

|

AUDIT_SAVE_INPUT_XML |

Null (N) |

When set to Y, Input XML submitted with a transaction is stored in the Audit Database along with the calculation results. If set to N or left null, Input XML is not saved to the Audit Database. Regardless of the setting of AUDIT_SAVE_INPUT_XML, the result of a reversal is always Null. |

|

AUDIT_TRANSEDITOR_ACTIONS |

Null (Off) |

Set to Y to enable writing of TransEditor actions to the audit database. If set to any other value or Null (default), TransEditor actions are not stored in audit. |

|

INVOICE_INCLUDE_ALL_MESSAGES |

Null (Off) |

Default setting is Null (Off) which means that not all messages from invoices are available for audit.. Set to Y to allow auditing of all messages regardless of the company message threshold setting.

|

|

PESSIMISTIC_AUDIT_DATA_SAVE |

N (No) |

Do not change this value from the default setting unless you have been directed to do so in the ONESOURCE Indirect Tax Determination Installation Guide or by Customer Support. By default, Determination uses an optimistic approach to database insertions: no database records are examined prior to insertions. This is faster than a pessimistic approach (Y), which looks for existing records before making insertions. |

|

SABRIX_MASTER_NODE |

Null |

Only set this parameter in a non-clustered environment. In a clustered environment, it is set automatically by Determination. In a non-clustered environment only, you must set this parameter to Y to enable ONESOURCE Indirect Tax Monthly Content Updates. |

Calculation Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

COUNTRIES_USING_POSTCODE_LOOKUP_POLICY |

NULL (Off) |

Set this parameter if you want Determination to evaluate postcodes and cities in countries other than the US. For example, if you are doing transactions in Puerto Rico and use <COUNTRY>PR</COUNTRY>, you would insert PR into this parameter. Note that this value is case-sensitive. If you want several countries to use this lookup policy, then separate each value with a comma. If you use both two and three character codes for a country, include each separated by a comma. This parameter uses Determination's default logic for postcodes and cities. For instance, if a city spans multiple counties, and no Zip +4 is provided, Determination selects the default city. If you decide to use this parameter, be sure that your source system supplies postcode data for the selected countries. This is also listed under "Address Validation Parameters." |

|

DEFAULT_IS_ESTABLISHED_TRUE_INTL |

N |

This parameter sets establishment status for those international zones and authorities that have not previously been configured on the Established Authorities pages.

When new authorities and zones are imported into Determination through Content Updates, they inherit the default set here. You can then modify the establishment status for individual zones and authorities on the Established Authorities Zones pages. |

|

DEFAULT_IS_ESTABLISHED_TRUE_US |

Y |

This parameter sets establishment status for those US zones and authorities that have not previously been configured on the Established Authorities pages.

When new authorities and zones are imported into Determination through Content Updates, they inherit the default set here. You can then modify the establishment status for individual zones and authorities on the Established Authorities Zones pages. |

|

EVALUATE_ |

Opt. |

For non-US custom authorities, this setting overrides bottom-up terminates processing behavior in the zone tree.

For details on this parameter, see the topic Custom Authorities Associated with Bottom‑up/Terminate Zones. You can also set this value as a company option on the Options tab of the Companies page. |

|

EVALUATE_US_CUSTOM_ |

Opt. |

For US custom authorities, this setting overrides bottom-up terminates processing behavior in the zone tree.

For details on this parameter, see the topic Custom Authorities Associated with Bottom‑up/Terminate Zones. You can also set this value as a company option on the Options tab of the Companies page. |

|

INCLUDE_ |

Opt. |

For non-US custom authorities, this settings tells Determination whether to include custom authorities as candidates for tax calculation if it finds them above the termination zone.

This only works in combination with other settings. For details, see the topic Custom Authorities Associated with Bottom‑up/Terminate Zones. You can also set this value as a company option on the Options tab of the Companies page. |

|

INCLUDE_US_CUSTOM_ |

Opt. |

For US custom authorities, this settings tells Determination whether to include custom authorities for consideration in tax calculations if it finds them above the termination zone.

This only works in combination with other settings. For details, see the topic Custom Authorities Associated with Bottom‑up/Terminate Zones. You can also set this value as a company option on the Options tab of the Companies page. |

| INDIA_CURRENCY_CODE | INR |

This parameter applies to services exports from India only. Determination performs a currency comparison between the Indian currency code (INR) and the document currency code.

This parameter defaults to INR and only needs to be updated if the currency code specified for Indian Rupee changes to something other than INR. |

| MAX_CUSTOMERS_PER_GROUP | 10000 |

Controls the number of customers that can be assigned to a customer group. Valid values are between 1 and 250000. |

|

PLACE_OF_SUPPLY_HANDLING |

SELLER_COUNTRY |

Parameter specifies which tax result is returned in XML output for invoice printing, audit, and reporting purposes. For example, VAT rules include a Reverse Charge provision: VAT on B2B, cross-border supply of services (i.e., Buyer and Seller in different EU countries) is self-assessed by the Buyer. By default, the seller country tax result is returned. If this result meets your needs, this configuration parameter is not needed. For more information, see Place of Supply of Services. Parameter values are:

The configuration parameter sets this value system-wide. You can set this value as a company option on the Options tab of the Companies page. If both company option and configuration parameter are set, the company option takes precedence. If you use SAP or Oracle as your ERP system, do not use the BOTH value with the EU Place of Supply Handling company option. Use only the SELLER_LOCATION or BUYER_LOCATION values. |

|

POST_VERSION_511_TAX_TYPES |

N |

Uses ER or IR (EU Buyer Services reverse charges) tax types implemented after Version 5.1.1. Default uses tax types available in previous releases.

For more information, see the Tax Calculation XML Elements for invoice or line input or output. |

|

PROCESS_NON_ |

Y |

Some fees authorities and food and beverage authorities do not use standard rate codes (CU, SU, or ST). In those cases, they use a no-tax rule to prevent tax assessment when not applicable and to prevent application of default state cascading tax rules. This parameter checks custom cascading rules to determine if the rule being processed is a custom cascading rule or if the authority being processed is a custom authority.

To set this behavior for a single company, use the Options tab of the Companies page. The company option overrides the setting of the configuration parameter. |

|

RULE_SELECTION_BY_COMMODITY_CODE |

N |

This parameter sets the behavior for matching a product code. When a UNSPSC code is passed in a transaction, all custom and standard rules for an authority may be compared to select the closest match to the code in the transaction:

For example, the following product codes may be evaluated:

When the parameter is set to Y, the line item with the product code 81111201 uses Rule #2 because it is a closer match rather than Custom Rule #1. This parameter sets behavior for all companies. You can set this value as a company option on the Options tab of the Companies page. |

|

SINGLE_ZONE_ALIAS_ENABLED |

Null (Off) |

Set this to the value of Y only if you want to turn off multiple zone alias processing. This is also listed under "Address Validation Parameters." |

|

STRICT_CUSTOMER_LOOKUP |

Y |

If not present or set to Y, customer lookups are based on the value of the input XML element <CUSTOMER_NUMBER> only (ignoring <CUSTOMER_NAME>). If set to N, the value of <CUSTOMER NAME> is considered as well. In this case:

|

|

TAX_DATE_DEFAULT_MOVEMENT_DATE |

N |

This configuration parameter specifies the default behavior to be used if date determination logic and rules are not used to specify the Tax Determination Date, Tax Exchange Rate Date, and Tax Point Date. If set to Y, then Determination would use the first available date from the following list:

If set to N or blank, Invoice Date is used to specify these dates in the absence of applicable date determination logic and rules. |

|

US_DEFAULT_COUNTRY |

N |

Determines the behavior used if a country is not specified within an address. For example, if a transaction includes a ship to address with Washington for the state and 98101 for the zip code, but does not include a value for the country. If set to Y, Determination will use US (United States) as the country for any addresses where the country element is not specified but other elements are specified. If set to N, a country must be specified for any addresses where other elements are specified. Otherwise, the transaction will fail. This parameter applies to all address types:

|

|

USE_BUSINESS_SUPPLY_ |

N |

Parameter specifies how tax determination is calculated for business supply.

|

|

USE_CALC_GROSS_AMT_ |

N |

This flag is used in conjunction with reverse-from-tax transactions:

Although this flag affects the gross amount value returned in the XML output, it has no effect on the audit data, which still contains records for both the calculated gross amount and the gross amount (if you provided it). |

|

USE_CALC_GROSS_AMT_ |

N |

This flag is used in conjunction with reverse-from-total transactions:

Although this flag affects the gross amount value returned in the XML output, it has no effect on the audit data, which still contains records for both the calculated gross amount and the gross amount (if you provided it). |

|

USE_SIMPLE_REGISTRATIONS |

N |

If set to Y, use the Simple Registration Mask for Authorities instead of the standard Registration Mask for validating Registrations. Simple Registration Masks can be passed in and used in tax calculations, but cannot be entered on the Registrations page. |

|

ZERO_TAX_RATE_FOR_EXEMPT_CUSTOMER |

N |

This parameter sets the <TAX_RATE> returned in a transaction that has been exempted due to an exempt customer or certificate.

|

|

ZONE_ALIAS_DISABLED |

N |

If set to Y, Zone Alias application will be disabled for calculations. This may be desirable if you want to increase calculation performance and zone aliases are not used in your implementation. |

Certificate Manager Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

CERTIFICATE_MANAGER_URL |

Null (None) |

To enable the Certificate Manager links in Determination, insert your Certificate Manager URL. Use the following format: http://<server>:<port>/tax-certificate-manager-app Users need one of the following roles to access Certificate Manager:

When setting this parameter, you must change the selected company in the upper right corner of the page before the change will take effect. |

Clustering Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

CLUSTER_CHANNEL_PROPERTIES_FILE |

Null (None) |

This parameter is not allowed if you are using UDP with default ports and IP addresses. If you are using UDP with non-default settings, insert the value udpcluster.xml. If you are using TCP, insert the value tcp-tcpping-cluster.xml. This parameter must match the parameter determination.infinispan.jgroups.configuration_file in the determination_application_overrides.properties file. See the installation and upgrade guide for your platform for more information. |

|

ENABLE_SERVER_COMMUNICATION |

Null (No) |

If you installed into a cluster, use this parameter to enable Determination on the additional nodes. set to Y to enable cluster communications between nodes configured on your application server. This setting is not enabled by default, and the parameter should be added immediately after implementing Determination in a clustered environment Be sure to add this parameter while you are running only one server; then, when you start additional servers, they will read this parameter and join the cluster. To test cluster communications, log onto Determination as ^dba and run the Menu > System > Diagnostics > Cluster View tool. If you set this parameter to Y, you must also disable the SABRIX_MASTER_NODE parameter. See Audit Parameters for more information. |

Import Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

CONTENT_MESSAGE_SUPPRESSION |

N |

Set this parameter to Y to suppress the message center that is sometimes displayed when Determination is configured for automatic tax data updates. |

|

SDI_HIERARCHY_DELIMITER |

. |

Specifies the single-character delimiter to be used when specifying product category, product zone, and exemption certificate zone hierarchies using Import/Export import format. The default is a period (.). Other valid values are: > ? / @ # % ^ & * ( ) + |

|

SDI_IMPORT_WAIT_TIMEOUT |

15 |

Specifies the time, in minutes, that the system will wait before considering an import to have failed if it is not progressing. The default is 15 minutes. This setting helps to ensure that two imports will not run simultaneously. If you set the value too low, and multiple import processes are allowed to run at the same time, you may experience unexpected results. |

|

SDI_OVERRIDE_TRANSACTIONS |

N |

By default, Determination will perform a database COMMIT after every 100 records is imported. However, some imports specify a different commit pattern as part of the transaction roll-back functionality. Changing this setting to Y will cause Determination to ignore any commit patterns specified within an import. This parameter should only be used if requested by Customer Support. |

|

SDI_TEMP_FILE_DELETE_INTERVAL |

86400000 (1 day) |

Specifies the amount of time, in milliseconds, between each run of the temporary file deletion process. The default is one day (86400000 milliseconds). Note that the timer re-starts each time the application server is bounced, and you must bounce the server each time you change this parameter. |

Logging Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

DAILY_LOG_ROLLING |

N |

Determines whether a new log file should be created each midnight, closing the existing one. Valid values are Y (enable rolling) or <any other value> (disable rolling). The previous name for this parameter, LOG_ROLLING_ENABLED, remains for backwards compatibility. If parameters DAILY_LOG_ROLLING and MAX_LOG_FILE_SIZE are both defined, the behavior from MAX_LOG_FILE_SIZE is used. |

|

LOG_INVOICE_CALC_PERFORMANCE |

N |

Turns on performance logging (Y). If you use this feature, be sure that the Configuration parameter LOG_LEVEL is set to ERROR. For more information on how to gather and analyze performance statistics, see Accessing Log Files. |

|

LOG_LEVEL |

INFO |

Determines whether a log file will be created and, if so, what level of detail it will contain. Valid values are:

|

|

MAX_LOG_FILE_SIZE |

(No Default) |

Specifies the maximum log file size in bytes before log rolling occurs. KB, MB, and GB can be used; for example 100MB. When enabled and the maximum file size has been reached:

If parameters DAILY_LOG_ROLLING and MAX_LOG_FILE_SIZE are both defined, the behavior from MAX_LOG_FILE_SIZE is used. |

Parameters Set on the Configuration Tab of the Import/Export Page

Parameters specific to the Automatic Content Update include:

- Automatic tax data update functionality is enabled by Import/Export.

- While tax data update parameters are listed here and can be edited/configured on this page, Thomson Reuters recommends that you configure them on the Import/Export Configuration page, where, you can select appropriate values from pull-down menus for most items.

Contact Consulting Services for additional information.

|

Parameter |

Description |

|---|---|

|

PROXY_HOST |

Get this value from your IT department. |

|

PROXY_PORT |

Get this value from your IT department. |

|

SDI_AUTO_ENABLED |

When set to Y, enables the automatic download of Content Updates depending on the values of the other parameters in this table. |

|

SDI_AUTO_LEVEL |

Specifies the actions the Automatic Content Update process will perform without user intervention:

In all cases, status and diagnostic information is sent to the SDI_NOTIFY_USER using the method specified in SDI_NOTIFY_TYPE. |

|

SDI_AUTO_FREQ |

The number, in hours, between automatic queries of the Customer Center to determine the availability of Content Updates for Determination. The default is 24. |

|

SDI_AUTO_FILE |

A directory path where the download files are stored before installation (for example, c:\temp or /tmp). If you do not specify a directory, the files are copied to the sabrix directory in the application server. |

|

SDI_NOTIFY_USER |

The Determination user name that will be notified whenever an action specified by SDI_AUTO_LEVEL takes place. The default is ^dba. The email address associated with this user in Determination is used in the SDI_NOTIFY_MAIL* parameters below. |

|

SDI_NOTIFY_TYPE |

One of the following notification mechanisms for status and diagnostic messages:

The default is BOTH. |

|

SDI_NOTIFY_MAIL_PASSWORD |

Password for the SDI_NOTIFY_USER's email account on the SDI_NOTIFY_MAIL_SERVER. The default is password. |

|

SDI_NOTIFY_MAIL_SERVER |

Mail server for sending email to the address associated with the user specified in SDI_NOTIFY_USER. Example: mail.sampleco.com. |

|

SDI_NOTIFY_MAIL_USERNAME |

Username for the SDI_NOTIFY_USER's email account on the SDI_NOTIFY_MAIL_SERVER. Example: samplecodave. |

Report Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

| APPLICATION_EVENT_HISTORY_TRACKING_ENABLED | N | Determination can track system configuration changes, as well as authentication information. These changes are available in the Application Event History report. To enable this feature, set the parameter value to Y. The following user roles have privileges to change this parameter:

|

|

GATHER_INVOICE_TAX_SUMMARIES |

No |

Consolidates data from the TB_INVOICES table for non-taxable basis, exempt amount, and tax rate. To set this behavior only for a particular Determination company, use the Gather Invoice Tax Summaries company option. You can set this value as a company option on the Options tab of the Companies page. |

Resource Management Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

AV_CACHE_ENABLED |

Y |

Set to N to disable zone caching for address lookups on memory-constrained systems (1GB or less). Set to Y to enable caching on higher-memory systems. |

|

BASE_SABRIX_DIRECTORY |

./sabrix |

This specifies the base directory on the application server under which various files used by Determination are stored, created, and referenced. This parameter can be set to any path specification valid on the application server for which the application server user has full access. The application server must be restarted each time this parameter is modified for the change to take effect. If you are running Determination in several application server instances on the same server, do not enter this parameter on the Configuration page. Instead, add this parameter in your start-up scripts to ensure that each instance logs to its own directory. If you choose to set this parameter in your start-up scripts, then you cannot change this parameter using the Configuration page. For details, see the ONESOURCE Indirect Tax Determination Installation guide that applies to your application server. |

|

MEMORY_LIMIT_THRESHOLD |

95 |

A threshold representing the percentage of JVM maximum memory consumption allowed before triggering an entity cache reset. Valid values are any number between 0 and 100. |

|

NUM_THREADS |

1 |

Maximum number of threads to use when processing invoices in a single batch. Valid values are any positive number. |

|

SDI_CACHE_AUTO_RESET |

N |

With this parameter set to Y, Determination will clear the cache for the node used to perform the import and any nodes belonging to the same cluster upon successful completion of a data import. |

|

VALIDATE_DATABASE_CONNECTIONS |

Null (Off) |

Specifies whether or not to validate the database connection before performing a calculation. This is generally only required in environments where the connection to the database is not always stable. Set to Y to enable validation, any other value or (Null) to skip validation before performing a calculation. |

Security and Password Parameters

Updates to password parameters impact existing users once they change their password for the first time after the parameter is updated. Password restrictions that were in place when the password was first created, such as the validity periods and forced changes, are carried over until the first password change.

Password expiration settings are also managed on the Edit Users page. For more information, see Edit Users.

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

AUTHENTICATOR_CLASS |

(No default) |

This parameter is for single sign-on and is the fully qualified external authenticator class name. For example, com.sabrix.uicontroller.SimpleAuthenticator). For more information, see Single Sign-On Setup in the Programmer's Guide. |

|

CALC_AUTHENTICATION_REQUIRED |

N |

If set to Y, then calculation authentication is enabled and non-authenticated transactions (sent to the xmlinvoice or auditinvoice servlets) generate a severe error message. The default is to not authenticate. If authentication is enabled, transactions must either:

|

|

LOGIN_LOCKOUT_PERIOD |

0 |

The period of time in minutes in which the user’s account should be locked. A zero value (0) indicates the lockout period is indefinite. |

|

LOGIN_MAXIMUM_ATTEMPTS |

3 |

An inclusive number of login attempts that are allowed before a user’s account is locked. |

|

LOGIN_MAXIMUM_ATTEMPTS_ENABLED |

N |

Indicates whether or not the user lockout feature is enabled. Valid values: Y or N. The ^dba user cannot be locked out. |

|

LOGIN_MAXIMUM_ATTEMPTS_PERIOD |

0 |

The period of time in minutes in which the maximum number of attempts is enforced. Zero indicates an attempt period does not apply. |

|

LOGIN_TIMEOUT |

20 |

Determines the length of inactivity, in minutes, before a login session times out. The maximum timeout allowed is 10080 minutes (one week). |

|

PASSWORD_EXPIRATION_ENABLED |

Y |

Determines whether or not user passwords expire. The default setting is Y (passwords do expire); to disable password expiration, set to N. Use PASSWORD_EXPIRATION_DAYS_TO_LIVE to specify the number of days between expirations. This must be set to N for single sign-on. |

|

PASSWORD_EXPIRATION_DAYS_TO_LIVE |

90 |

Determines the length of time, in days, before a user's password expires. Disabled if PASSWORD_EXPIRATION_ENABLED is set to N. The default is 90 days. |

|

PASSWORD_EXPIRATION_WARNING_PERIOD |

14 |

Specifies the time period between the first password change warning (which appears on the Home page after a user logs in) and the actual password expiration. The default value is 14 days. |

|

PASSWORD_FORCED_CHANGE_DISABLED |

N |

This is for single sign-on. This allows users to skip password changes and must be set to Y for single sign-on. For more information, see Single Sign-On Setup. |

|

PASSWORD_VALIDATION_ENABLED |

Y |

Determines whether or not password validation settings are enabled. The default setting is Y; to disable validation set to N. See the list of validation parameters below for more information. |

|

PASSWORD_VALIDATION_MAXIMUM_LENGTH |

60 |

If password validation is enabled, determines the maximum length of a valid password. If not specified, Determination defaults to 60. |

|

PASSWORD_VALIDATION_MINIMUM_LENGTH |

6 |

If password validation is enabled, determines the minimum length of a valid password. If not specified, Determination defaults to 6. |

|

PASSWORD_VALIDATION_NON_ |

Y |

If password validation is enabled, determines whether or not the password must include at least one non-alphabetic character (for example, 0-9 or !@#$%^*()_+|~-=\`{}[]:";'). If not specified, Determination defaults to Y (enforce inclusion of at least one non-alphabetic character). |

|

PASSWORD_VALIDATION_NON_ |

1 |

If non-alphabetic characters are required (PASSWORD_VALIDATION_NON_ALPHA_CHECK_ENABLED is not set to N), specifies the minimum number of non-alphabetic characters required in the password string. If not specified, Determination defaults to 1. |

|

PASSWORD_VALIDATION_UPPER_CASE_CHECK_ENABLED |

Y |

If password validation is enabled, determines whether or not the password must include at least one upper-case alphabetic character. If not specified, Determination defaults to Y (enforce inclusion of at least one upper-case alphabetic character). |

|

REDIRECT_URL_EXTERNAL_LOGIN |

(No default) |

This parameter is for single sign-on and is the URL to which you redirect in cases such as these:

For more information, see "Single Sign-On Setup" in the Programmer's Guide. |

|

REDIRECT_URL_ON_FAILED_ |

(No default) |

Handles error conditions related to single sign-on and is the URL to which you redirect in cases such as these:

For more information, see "Single Sign-On Setup" in the Programmer's Guide. |

|

SABRIX_CUSTOMER_ID |

(No default) |

Your customer ID as provided by Customer Support. |

User Interface Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

COMPANY_SELECTION_SEARCH_ENABLED_COUNT |

2000 |

If the number of companies available exceeds the value entered, the Company menu in the top right corner becomes the Change Selected Company link, which launches a new window to search for and select a company. This parameter uses an integer value, not a string. The maximum allowed value is 2147483647. |

Web Service Parameters

|

Parameter |

Default Setting |

Description |

|---|---|---|

|

CUSTOMER_MANAGEMENT_SERVICE_ |

Y |

Controls authentication for customer management web service by default. Security authentication for the service must be manually disabled, if desired, by setting parameter to N. For more information, see the Exemption Certificate Management Implementation Guide, available from the Support Network. |

|

EXEMPTION_CERTIFICATE_MANAGEMENT_SERVICE_ |

Y |

Controls authentication for exemption certificate web service by default. Security authentication for the service must be manually disabled, if desired, by setting parameter to N. For more information, see the Exemption Certificate Management Implementation Guide, available from the Customer Support or the Knowledge Base. |

|

SOAP_CALC_AUTHENTICATION_REQUIRED |

Y |

This is for the Tax Calculation web service and controls whether you must supply credentials for tax calculations and audit recording. For each invoice, Determination evaluates the user name and password found on the batch level (IndataType).

WSS_AUTHENTICATION_REQUIRED must also be enabled. |

|

SOAP_CONFIG_AUTHENTICATION_REQUIRED |

Y |

When enabled, you must supply credentials for the following web services:

Set to N to turn off authentication for these services. |

|

WEB_SERVICE_XSD_VALIDATION |

N |

If you want your messages validated against the XSD, set the value of WEB_SERVICE_XSD_VALIDATION to Y. If you disable validation using the value of N, messages are not validated; however, your messages must still conform to the XSD in order to be processed. If you turn on validation, you improve your error messages, but you also generate some performance overhead. |

|

WSS_AUTHENTICATION_REQUIRED |

N |

This controls access to the Tax Calculation and Zone Lookup Services. When this is set to Y, the SOAP security header is examined for a valid Determination user name and password.

If you enable this parameter, you also generate some performance overhead. |