Allocated Charges

Using Allocated Charges improves the accuracy of your tax liabilities by adjusting how a shared charge (like freight) is taxed. In some states, taxes on freight or shipping charges are based on the taxability of all items in the invoice, excluding the allocated charges. In these cases, Determination uses the effective tax rate for the invoice to calculate a basis percentage, which is applied to each allocated charge line. You can include multiple allocated charges on a single invoice.

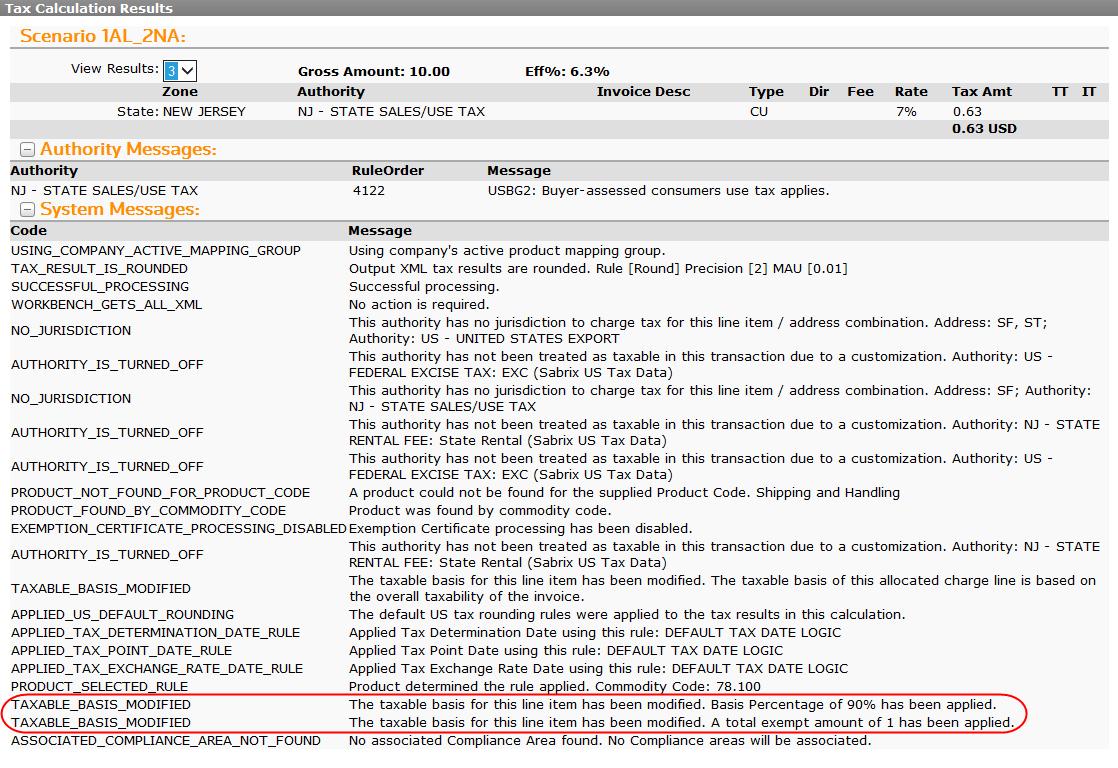

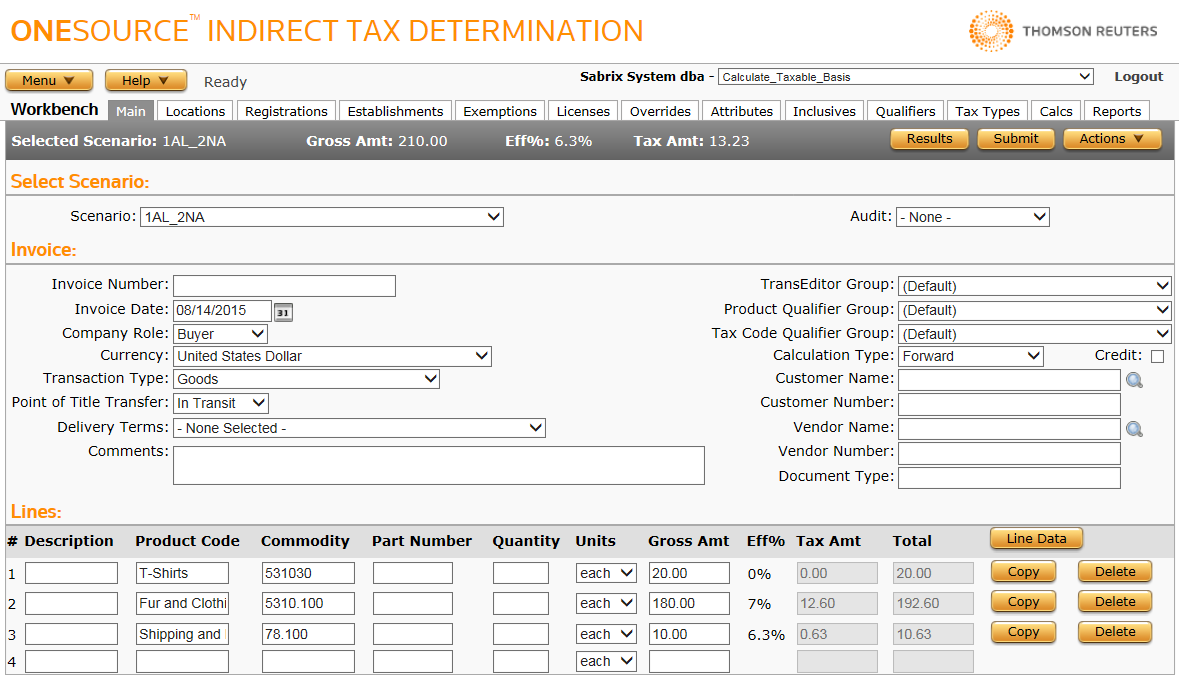

In the following example, the price for each line item varies as does its taxability. The fur coats are taxed at the state's standard rate of 7%, while the t-shirts are exempt from tax. The invoice total of $210 consists of $180 in furs (taxable goods), $20 in t-shirts (exempt goods), and $10 for shipping. Since the state requires freight to be an allocated charge, the resulting tax calculation is 90%, or $9.00, of the original $10 shipping charge.

Related Charges and Allocated Charges cannot be used in the same transaction. Including a Related Line Number in a transaction excludes any Allocation Charge rule from applying to that transaction.

Allocated charge rules are delivered as part of the standard US tax content. To see if an allocated charge rule applies to a specific authority, check the Rules tab on the Basic Info (Rates and Rules) window. For additional information, see:

System Messages

Workbench provides System Messages with details on how the tax is allocated for each line item. Select Results to view the messages related to the active scenario.