Cascading Rules and Rates for Products

Cascading rules and rates allow you to quickly apply desired taxability to all authorities of a common tax type of the same level in the zone tree. This avoids entering redundant rules at the local level for each child authority.

Cascading rules and rates apply to authorities that have the same type and are located in the same state as the state authority. Only state and country level authorities permit cascading rates and rules--county, city, and district level authorities do not.

Products assigned to child authorities follow the parent authority taxability unless another rule is created on the child product instructing it to do otherwise. Most states have cascading rules set up to apply standard statewide (parent) sales and use taxes to all local jurisdictions (child).

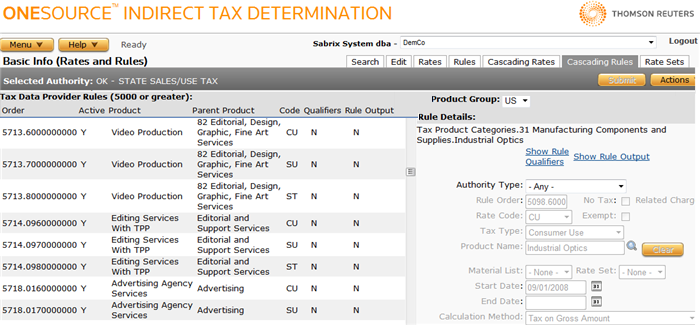

You can set up and manage cascading rules on the Cascading Rules tab of the Basic Info (Rates and Rules) page:

For procedures about cascading rule tasks, see Cascading Rules. For a general discussion, see Rules.

Zone Tree Hierarchy

The zone tree is a hierarchical representation of U.S. geographic zones that includes country, states, counties, cities, zip codes, and geocodes (zip +4), in descending order. Each of these zones can be assigned to one or more taxing authorities, which in turn have rates and rules assigned to them.

Rules that apply across an entire state are entered in state authorities, rules that apply to a specific county are entered in county authorities, and so on. Cascading rules can only be associated with country and state authorities, but the rules are inherited by child authorities, as explained above.

Rules are Calculated in Order

Determination provides thousands of products in the Tax Data Provider (TDP). Each TDP product has a unique identifying commodity code in the United States.

Each product also has an identifying rule order, generally a four-digit number followed by a decimal and an additional digit to signify the tax type. Determination evaluates rules in ascending order, so it is important to assign the correct rule order when creating a rule.

The TDP manages rules numbered 5000 or greater. Rules reflect three taxing options in the U.S.: consumer's use (.1), seller's use (.2), and sales tax (.3). If they are cascading rules, the tax types are denoted with a .6, .7, and .8, respectively. For example, the four digit rule order for poster boards is 5211. The consumer's use tax rule is represented by 5211.1 and the cascading consumer's use tax rule would be 5211.6.

Exempt TDP rules (those for which no tax is required) are designated by selecting the Exempt checkbox on the Cascading Rules page. Exempt rules typically do not have a decimal number following the rule order. If a cascading rule is created on an exempt rule, it is designated with .5.

Non-TDP companies (those that do not use the Determination-provided Tax Data Provider products) manage custom rules (numbered 1-4999). You can set these rules with any values you require. They are numbered below 5000 so that they are calculated before TDP rules. If a custom rule has a number greater than 5000, Determination reports it as an error.

International authorities do not use cascading rules in the Tax Data Provider.

Custom Rule Order has Precedence

If you want to override the TDP results for all authorities of a similar authority type, you would add custom rules at the state or country level. You must be aware of other custom rules you have created. The rule order you assign to a product not only must be lower than 4999, but must also be lower than the rule order you want to override. With a lower number, Determination will calculate it before the rule you want to override.

How do Cascading Rules Apply to Authorities?

Let's look at an example of cascading rules that apply to all transactions. The zone tree hierarchy shows an example of Westville, a city in Oklahoma. As you can see, Westville is a child of Adair county, which is in turn a child of the state of Oklahoma. The zip code of 74965 is a child of all of these zones. To apply state level Oklahoma rates and rules to all zones below it, a cascading rule must be created on the state level:

The Oklahoma State Sales/Use Tax authority is attached at the state level of Oklahoma in the zone tree, which is typical for most states. Using the standard sales/use tax authority, any rules entered at this level would apply to state level transactions, and cascading rules entered at this level would "cascade" down to all children by default.

On the Cascading Rules tab for the OK - STATE SALES/USE TAX authority, we show the selected product Video Production. Note that its rule order is 5713 for sales tax transactions and the appended .8 indicates cascading sales tax transactions. This tax treatment will cascade all the way down to the Westville city authority since the rule is placed on the top-level state authority.

Note that taxability for the Video Production product cascades down to both county and city authorities because the Authority Type is set to Any for this rule.

We can view the tax results in a Workbench scenario. The assigned rate code ST assigns this rule to each of the ST rates entered on child authorities: 4.5% state, 0.75% county, and 3.75% city.

When the appropriate commodity code (82131603) is entered in a workbench scenario for the Video Production product, and the shipping locations are placed in Westville, OK, we see the desired results. In the Authority Messages section:

- Rule order 5713.3 signifies state level rules are applied, as shown by the state authority in the left column.

- Rule order 5713.8 appears on the following two lines for county and city authorities, signifying that a cascading rule has been applied.

Always create a Workbench scenario to test a cascading rule before you put it into production. Because a cascading rule overrides the default taxation, it is important to make sure the results are what you expect.