Triangulation Simplification

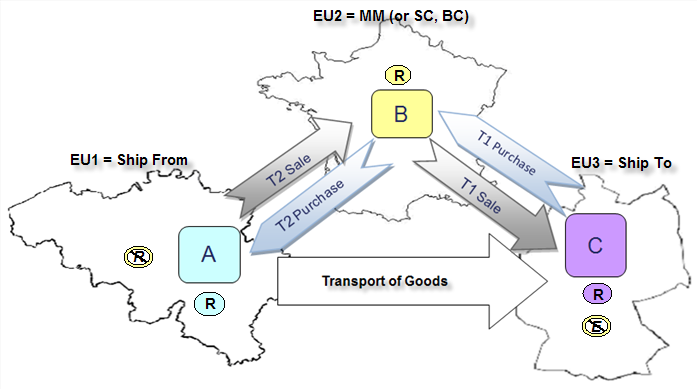

Triangulation simplification, or simply triangulation, is a special regime in the EU that applies to qualifying chain transactions. In triangulation, all countries in the transaction are different EU member states, registered in their own country.

Triangulation is defined as:

- A sale of goods.

- Three taxable persons (ABC) in three different EU member states.

- All transactions take place in the EU.

- There are two sale transactions: A to B (T2) and B to C (T1).

- One transport is directly from A to C, either ship or pickup.

- Establishment of Middleman in the Ship To location (C) depends on the authority option (country specific rule.) See details in the explanations below.

To compare triangulation simplification to chain transactions, see Chain Transactions.

Regulations Governing Triangulation Simplification

Each EU member state ensures that VAT is not charged on the intra-community acquisition of goods within its territory. These conditions must be met:

- The acquisition of goods is made by a taxable person who is not established in the concerned member state but is identified for VAT purposes in a different member state.

- The acquisition of goods is made for the purposes of the subsequent supply of these goods, in the concerned member state, by the taxable person in A (as shown above).

- The goods acquired by the taxable person are directly dispatched or transported from a member state other than that in which he is identified for VAT purposes.

- The person to whom the goods are supplied is another taxable person, or a non-taxable legal person, who is identified for VAT purposes in the concerned member state.

- The person to whom the goods are supplied has been designated as liable for payment of the VAT due on the supply carried out by a taxable person who is not established in the member state where tax is due.

This illustration shows the transactions, where R means Registration, E means Establishment, and T means Transaction. The following table explains the conditions.

|

Type |

All Member States |

Country-specific Conditions |

|

|---|---|---|---|

| Registration/ |

Each company uses a registration in a different EU country:

|

Option 1 |

Option 2 |

|

B must not be established in EU3 or |

B must not be registered in EU3 |

||

|

B must not be registered in EU1 or |

B status in EU1 doesn't matter |

||

|

Transportation |

Goods must be transported directly from EU1 to EU3 |

A or B must arrange transport or |

Transport may be arranged by any party |

Evaluating Triangulation Simplification

The following tables explain how triangulation simplification is evaluated using the Middleman role, compared to Seller and Buyer. When using Seller and Buyer role, the assumption is that the first seller (Warehouse A) is registered in the Ship From location, which is a condition for simplification.

|

Sales Invoice by Sales Unit (B) |

||

|---|---|---|

|

Example 1 |

Role |

Registration |

|

Sales Unit (B) |

Middleman |

MM (SF, ST) |

|

End Customer (C) |

Buyer |

ST |

|

Warehouse (A) |

Seller |

SF |

|

Example 2 |

Role |

Registration |

|

Sales Unit (B) |

Seller |

SP (SF, ST) |

|

End Customer (C) |

Buyer |

ST |

|

Warehouse (A) |

not applicable |

Assumed to be registered in SF |

|

Purchase Order by Sales Unit (B) |

||

|---|---|---|

|

Example 1 |

Role |

Registration |

|

Sales Unit (B) |

Middleman |

MM (SF, ST) |

|

End Customer (C) |

Buyer |

ST |

|

Warehouse (A) |

Seller |

SF |

|

Example 2 |

Role |

Registration |

|

Sales Unit (B) |

Buyer |

BP (SF, ST) |

|

End Customer (C) |

not applicable |

Assumed to be registered in ST |

|

Warehouse (A) |

Seller |

SF |

For example transactions, see Chain Transaction and Triangulation Use Cases.