Tax Code Qualifiers

Menu > Logic Settings > Tax Code Qualifiers

In some cases, you may want to create or modify ERP tax codes based on elements in the tax result. On the Tax Code Qualifiers page, you can manage Tax Code Qualifier groups, Tax Code Qualifiers, and conditions. Using the Actions menu, you can add, copy, and delete qualifiers, and view qualifier properties.

Determination offers two types of tax code qualifiers, and maintains each in separate groups.

|

Type |

Description |

|---|---|

|

Static |

A tax code qualifier which conditionally replaces the existing ERP tax code with a constant value. |

|

Dynamic |

A tax code qualifier which conditionally replaces the existing ERP tax code with the concatenated value of a selected number of fields from the tax result. |

For more information about the two qualifier groups, see Tax Code Qualifiers.

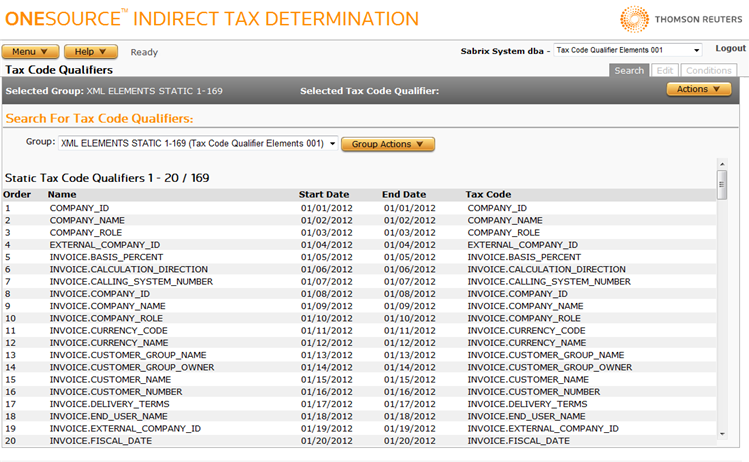

Tax Code Qualifier Groups

On the Search tab, you select a Tax Code Qualifier group and view the list of existing tax code qualifiers and their basic properties. Use the Group Actions menu to add, rename, delete, and view or export Group Properties. Once the group is selected, you can maintain its tax code qualifiers.

Each company has a default tax code qualifier group, which cannot be deleted. You can, however, rename the default group and view its properties.

Only the qualifiers that belong to the selected group are listed. The list shows static or dynamic tax code qualifiers, depending on the group type.

- Static tax code qualifiers are listed by order number.

- Dynamic tax code qualifiers are by order number. The first active tax code qualifier in the list for a given date is selected.

Add a tax code qualifier group

- Click the Group Actions button beside the Tax Code Qualifier Group name.

- Select Add Static Group or Add Dynamic Group.

- Enter a unique name for the group and click OK.

You cannot reuse an existing group name. If you try to add a name that is already in use, a message notifies you. Click OK and enter a different name.

Rename a tax code qualifier group

- Click the Group Actions drop-down list and select the group you want to rename.

- Click the Group Actions button beside the Tax Code Qualifier Group name and select Rename.

- Enter a unique name for the group and click OK.

You cannot reuse an existing group name. If you try to add a name that is already in use, a message notifies you. Click OK and enter a different name.

Delete a tax code qualifier group

When you delete a tax code qualifier group, all tax code qualifiers that belong to the group are also deleted.

- Click the Group Actions drop-down list and select the group you want to delete.

- Click the Group Actions button beside the Tax Code Qualifier Group name and select Delete.

- A message warns you that all group contents will be lost. Click OK to delete.

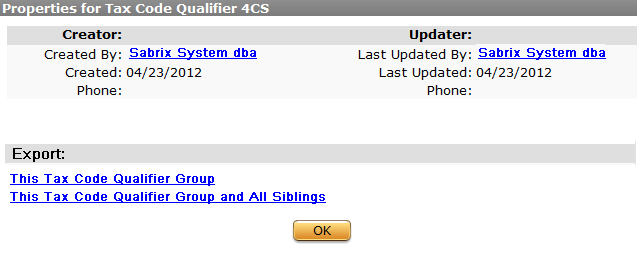

Export a tax code qualifier group or a tax code qualifier group and its siblings

- Click the Group Actions drop-down list and select the group you want to view.

- Click the Group Actions button beside the Tax Code Qualifier Group name and select Properties.

-

If desired, click a linked item to export the group or the group and its siblings. The export is an .xml file:

You are prompted to Open or Save the .zip file, or press Cancel to quit.

- Click OK to close the window.

Tax Code Qualifier Actions

Use the Edit tab to perform tasks on a selected qualifier. Many of the actions are also available on the Search page.

You can edit an existing qualifier or use options on the Actions menu to Add Qualifier, Add Condition, Copy Qualifier, Delete Qualifier, and view or export Qualifier Properties. The available parameters depend on the qualifier type: Static or Dynamic.

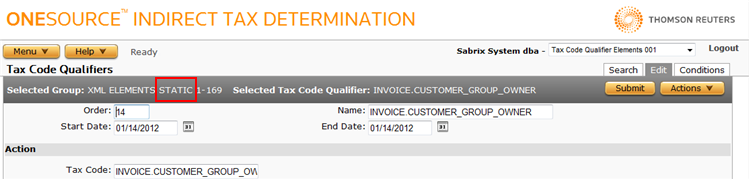

This example shows the editable fields for a Static tax code qualifier:

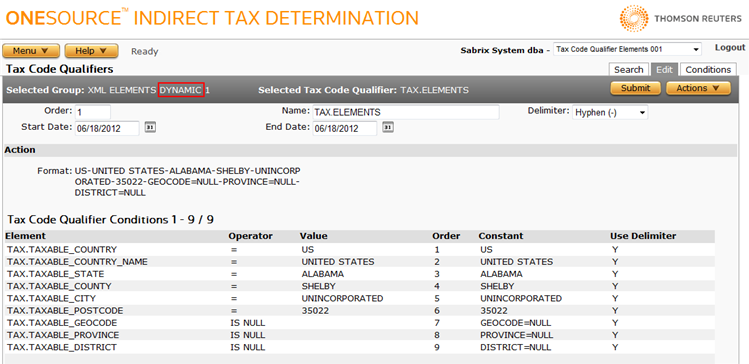

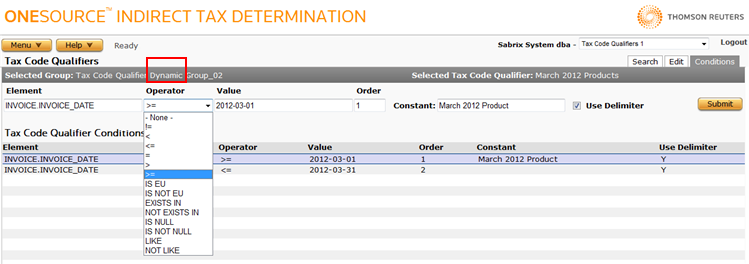

This example shows the editable fields for a Dynamic tax code qualifier:

You may want to create a catch-all static tax code qualifier that will set the tax code for any unmatched tax codes to a standard tax code. To do so, create the static tax code qualifier as the last in your list, and either set no conditions or set conditions that will always be matched for a transaction.

Note that static tax code qualifier groups and dynamic tax code qualifier groups are maintained separately and cannot be mixed.

Edit a tax code qualifier

- On the Search tab, select a Group and then select the qualifier you want to edit.

- On the Edit tab, change the values as needed and click Submit to save your changes.

Add a tax code qualifier

- From the Actions menu, select Add Qualifier. The type of qualifier depends on the selected group type: Static or Dynamic.

-

Enter the parameters for the tax code qualifier using the following table:

Tax Code Qualifier Parameters

Field

Req?

Description

Order

Y

Specifies the order in which the qualifier will be evaluated.

- If not specified or it has a number greater than the last item, the system automatically assigns the last order number of all tax code qualifiers.

- If you set an order number, the system assigns the specified position in the list of qualifiers, and re-orders existing qualifiers to accommodate it.

Name

N

The name of the qualifier or other descriptive information.

Start Date

Y

The date (MM/DD/YYYY) on which the tax code qualifier becomes active.

End Date

N

The date (MM/DD/YYYY) on which the tax code qualifier terminates. If blank, the tax code qualifier will remain effective indefinitely.

Delimiter

Y

Available only for dynamic tax code qualifiers. Specifies the character to separate each concatenated element in a dynamic qualifier. The drop-down list shows options, such as underscores, hyphens, or periods.

Tax Code

Y

Contains the actions that will be taken if the tax code qualifier is selected. Enter a tax code to be set on an invoice.

- Static: If the selected tax code qualifier is static, the tax code value is applied to the ERP tax code in the tax result.

- Dynamic: If the selected tax code qualifier is dynamic, the tax code value replaces the ERP tax code in the tax result with a new value specified by the first active associated tax code qualifier. Each element in the qualifier is evaluated against conditions before it is applied to the new tax code value.

No validation is done on the entry; you must be careful to enter correct values based on the company configuration.

- Click Submit to save your changes.

Copy a tax code qualifier

You can copy an existing tax code qualifier and change its values as desired. This is a safer option than changing the values of an original qualifier.

- On the Search tab, select a tax code qualifier in the currently selected Tax Code Qualifier Group.

- Click Actions and select Copy Qualifier.

- Use the Tax Code Qualifiers parameters table to edit values, if desired.

- Click Submit to save your changes.

Delete a tax code qualifier

- On the Search tab, select a tax code qualifier in the currently selected Tax Code Qualifier Group.

- Click the Edit tab.

- From the Actions menu, select Delete Qualifier.

- Click OK to confirm deletion or Cancel to quit.

Tax Code Qualifier Conditions

On the Conditions tab, you manage the conditions associated with the selected tax code qualifier. You can Add, Delete and view Condition Properties for the selected tax code qualifier. Tax Code qualifiers are listed in order in which they are evaluated.

How Determination evaluates the conditions depends on whether the qualifier is Static or Dynamic.

Tax code qualifiers are applied to the output of a transaction immediately before it is audited. Tax code qualifiers do not affect the taxability of the transaction. In this regard, it is similar to a TransEditor, and only affects the output results.

Dynamic Conditions Example

A Dynamic tax qualifier can have multiple conditions, each of which is evaluated in order. Each element is conditionally applied to the final result of the tax code qualifier. The first active tax code qualifier is always selected; Determination will never advance to the second active tax code qualifier in the group. The conditions only apply to the element, not to the tax code qualifier itself.

In this example, the tax code qualifier is evaluating products on invoices for dates in March 2012. It has two conditions, the first of which determines if the product is dated on or after 2012-03-01 (the operator representing greater than or equal to is selected). The second condition determines if the product date is on or before 2012-03-31.

Static Conditions Example

A Static tax qualifier can have multiple conditions, and Determination evaluates each tax result against all of the qualifiers by order number until all conditions are met or a condition is encountered that is not met. Conditions in a qualifier must all be true, or the qualifier is not matched.

In this example, the tax code qualifier is evaluating Ship From and Ship To countries. The first condition evaluated determines if the Ship From Country is not in the EU. If it is matched, it is applied. If it is not matched, the next active qualifier in the group will be evaluated, but the next condition of the current qualifier will not be evaluated. All conditions are evaluated in order, and if matched, are applied to the output of the transaction.

Add tax code qualifier conditions

- On the Search tab, select a Tax Code Qualifier Group, and then select a Tax Code Qualifier.

- Click the Conditions tab.

- From the Actions menu, select Add Condition.

-

Add conditions for the tax code qualifier using the following table:

Tax Code Qualifier Conditions

Field

Req?

Description

Element

Y

Specifies the name of a custom attribute or any other input element to be evaluated. As you type, the system suggests names.

A custom attribute may be referenced by its original name.

If there is a defined name for an attribute, the attribute name is displayed in the conditions table. If not, the original name (Attribute 1, Attribute 7, etc.) is shown.

Operator

N

Values in a drop-down list specify the action that determines how the value is evaluated:

- These operators may be entered in the Values text box: =, !=, <, >, <=, >=, LIKE, NOT LIKE

- These operators do not allow values to be edited: IS EU, IS GCC, IS NOT EU, IS NOT GCC, IS NULL, IS NOT NULL

- When either EXISTS IN or NOT EXISTS IN is selected, select a reference list from the drop-down list.

- When NONE is selected, the attribute will always be applied, regardless of the element value.

Value

Y

Lists available reference lists when the operator EXISTS IN or NOT EXISTS IN is selected.

Order

N

The order specifies the order in which the condition is evaluated after invoice processing.

For static tax code qualifiers, in order for a condition to be evaluated, the invoice line must match all conditions. Although it does not affect the results, calculation performance may be improved if you evaluate specific conditions before others.

For dynamic tax code qualifiers, condition is evaluated in order. Each element is conditionally applied to the final result of the tax code qualifier.

Use Delimiter

N

Specifies if the delimiter should be prefixed to the element before it is concatenated to the value. Available only for dynamic tax code qualifiers.

Constant

N

States a value that does not change. Available only for dynamic tax code qualifiers.

- Click Submit to add the qualifier.

Delete a tax code qualifier condition

- On the Search tab, select a Tax Code Qualifier Group, and then select a Tax Code Qualifier.

- Click the Conditions tab.

- From the Actions menu, select Delete Condition.

- Click OK to confirm deletion or Cancel to quit.