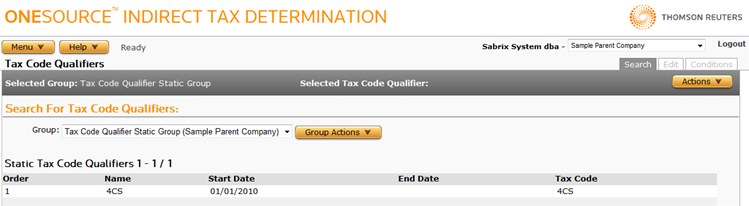

Tax Code Qualifiers

In some cases, you may need to create or modify ERP tax codes based on elements in the tax result. You can implement tax code qualifiers for this purpose.

Determination offers two types of tax code qualifiers: Static and Dynamic.

Static

A static tax code qualifier replaces the existing ERP tax code with a constant value when the condition is met.

When a static tax code qualifier group is selected for an invoice, Determination evaluates each tax result against all of the associated tax code qualifiers by order number or until it finds a matching qualifier (all of the qualifier's conditions match the tax result). Once Determination selects a qualifier, the ERP tax code for the tax result is replaced with the qualifier's static tax code value.

Dynamic

A dynamic tax code qualifier replaces the existing ERP tax code with the value of a selected number of fields from the XML elements for invoice and line input and tax output.

When a dynamic tax qualifier group is selected for an invoice, Determination replaces the ERP tax code for each tax result with a new tax code value specified by the first active tax code qualifier. The new tax code contains a string of concatenated elements associated with the qualifier. Determination evaluates against defined conditions before the new tax code value is applied. Elements are applied in the order you specify and all applicable elements are applied.

On the tabs of the Tax Code Qualifiers page, you can:

- Add, edit, rename, or delete a tax code qualifier group or view its properties.

- Add, edit, copy or delete a tax code qualifier or view its properties.

- Add, edit, or delete conditions associated with a tax code qualifier.

- View and export properties of qualifiers or qualifier groups.

For step by step instructions, see Tax Code Qualifiers. For more information about elements you can use in tax code qualifiers, see XML Elements.