Advanced Authority Configuration

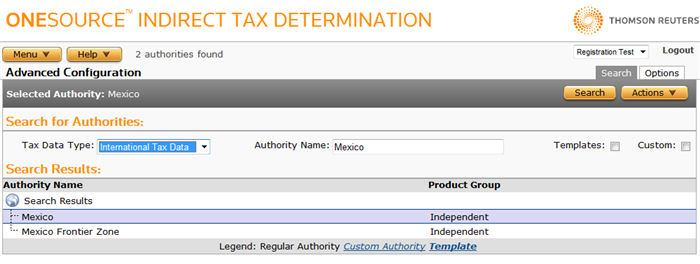

Menu > Tax Data > Authorities > Advanced Configuration

Transaction tax laws sometimes leave room for interpretation. You can use tabs on the Advanced Configuration page to override Determination tax law interpretation when appropriate for your environment.

The behavior of authorities is controlled by a collection of parameters called options. Each option has a name and four additional parameters: Condition, Value, Start Date, and End Date.

To change the behavior of standard authorities, you create custom authority options from copies of the tax data provider authority options. These custom options override the tax data provider authority options. For custom authorities, you make changes directly to the option values because there are no tax data provider authority options to override.

Actions on the Advanced Configuration page are limited by role, company type, and authority type. The table below describes two roles that grant privileges to these pages:

|

Role |

Tasks |

|---|---|

|

Custom Authority Manager |

A role for users who need to view or modify custom authority options. |

|

Tax Data Administrator |

A role for users who need to create, modify, delete, or view custom authority options. |

Search Tab

You can use Search tab of the Advanced Configuration page to:

- Locate an authority in United States or international tax data.

- View the properties of the selected authority.

Search for an authority

- In the Tax Data Type list, select United States Tax Data or International Tax Data.

- In the Authority Name field, enter the name of the authority or a few letters of the authority name.

- Click Search to locate authorities that match your entry.

- Click the authority from the Search list to select it.

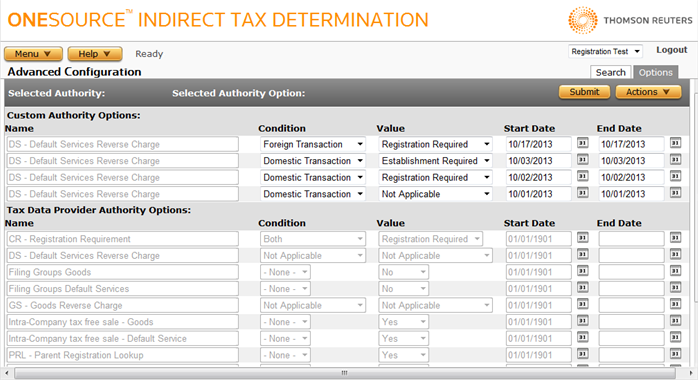

Options Tab

You can use the Options tab of the Advanced Configuration page to:

- Control voluntary tax situations and tax categorizations.

- Modify Custom Authority behavior by changing the value of one of the options associated with the template used to create the authority.

- Perform VAT overrides for custom interpretation of transaction tax laws, such as application of reverse charge rules, non-established taxable persons (NETP), exceptions, VAT groups, and so on.

For VAT purposes, you may want to turn off an authority if it does not pertain to your transaction. If needed, you can override the Turn Off Authority option to turn off the default authority. Click Actions > Add and then select Turn Off Authority in the Name field. In the Value field, select Yes to turn the Authority off.

If you prefer, set Start and End Dates if you want to turn off an authority for only a specific time frame.

Add a new authority option to override a Tax Data Provider setting

- Select Add from the Actions menu.

- Using the Authority Options Reference table below:

- In the Name field, select the option you want to override.

- In the Condition field, select the appropriate condition.

- In the Value field, select the desired value.

- In the Start Date field, click the Calendar icon and select the desired date.

- In the End Date field, enter no value if you want the option to remain in effect indefinitely; otherwise, select the desired end date on the calendar.

- Click Submit to save your changes.

Change an authority option for a custom authority

- Select the desired option that you want to change and select the desired Condition and Value.

- Enter the Start Date and optional End Date to define the validity period.

- Click Submit to save your changes.

If you enter an invalid value, Determination shows a message that explains the allowed entries. You can click Back to enter a valid entry.

Delete the currently selected authority option

You can only delete authority options that your company owns.

- In the Custom Authority Option section, select the option that you want to delete.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

Conditions in the Authority Options Reference table are dependent on laws in effect for the location, but in general, Domestic and Foreign transactions are defined as:

Domestic: Address parameters being evaluated are in the same country.

- For Goods transactions, Ship To and Ship From must be in the same authority or country. Goods consider Ship To and Ship From but not Seller Primary, Buyer Primary, or Primary Location.

- For Services transactions, Seller and Buyer Primary are in the same authority or country. Most services are not taxed by Ship From and Ship To but consider instead Buyer Primary, Seller Primary, and Supply Location.

Foreign: Both parties are in different authorities or countries.

|

Authority Options Reference |

|||

|---|---|---|---|

|

Option |

Description |

Condition |

Value |

|

For inter-provincial transactions, indicates whether the authority is a province of the south or north of Brazil, for purpose of ICMS Special Rate determination. |

|

-None- |

|

|

Chain Transaction Transportation |

A series of sales where the goods are shipped directly from the first seller to the final customer. Sets the delivery terms in each country for the party responsible for goods transport. Indicates whether pick-up cases (POTT='O', buyer responsible for transport) has an impact on the taxability of chain transactions for the authority. |

-None- |

When POTT is 'O' (origin):

|

|

CR - Registration Required |

Determines the registration and establishment requirements for a Seller to collect VAT on domestic, foreign, or both transactions for the specified authority. Determination first evaluates whether Reverse Charge (per transaction type) applies. If not, then Determination evaluates whether the seller can collect VAT. If Reverse Charge does not apply, the authority options associated with ability of the seller to collect VAT are evaluated (CR - Registration Required and DE - Domestic Establishment Only). |

|

|

|

DE - Domestic Establishment Only |

Determines whether or not non-registered domestic Sellers who are established in the authority are allowed to collect VAT on domestic sales. Applies only to:

Determination first evaluates whether Reverse Charge (per transaction type) applies. If not, then Determination evaluates whether the seller can collect VAT. If Reverse Charge does not apply, the authority options associated with ability of the seller to collect VAT are evaluated (CR - Registration Required and DE - Domestic Establishment Only). |

-None- |

|

|

ER - Establishment Required |

Determines whether or not non-established foreign entities are allowed to collect VAT on domestic sales. Applies to a particular domestic reverse charge transaction in the EU. Specifies the elements that must be present for the Buyer to reverse charge VAT. Determination first evaluates whether Reverse Charge (per transaction type) applies. If not, then Determination evaluates whether the seller can collect VAT. |

-None- Conditions are hard-coded in Determination. If the authority option is enabled, the reverse change will apply if:

|

|

|

Filing Groups <TRX_TYPE> |

Indicates whether transactions between companies that belong to the same VAT Group create taxability or not. VAT Group Registration can be set up in Company Data in Determination. VAT group registrations are enabled for those authorities which support it, for the transaction types those authorities support. Use this option to disable the VAT Group Registrations for a specified transaction type for this authority. See Working with VAT Group Registrations. |

-None- |

|

|

Foreign Seller - <TRX_TYPE> |

Determines whether or not a Not Liable tax line will be returned when a Seller is not required to charge tax, but the transaction has not met the requirements for reverse charge or some other exemption. For example, services are provided by a Seller who is located in another country and not registered with the authority. The Buyer is not eligible for reverse charge. If this option is set to Yes, a Not Liable tax line will be returned. If set to No, normal taxes will apply. |

-None- |

|

|

Include past terminate processing zones |

For bottom-up processing, this Determines whether a custom authority is included in calculations if the custom authority is above the termination zone. |

-None- |

For details about this authority option, see the topic Custom Authorities Associated with Bottom‑up/Terminate Zones. |

|

Intra-company tax free sale - <TRX_TYPE> |

Determines whether transactions between companies using the same VAT registration number for an authority are tax-free. |

-None- |

|

|

PRL - Parent Registration Lookup |

Enables the evaluation of registrations of a parent company as set up in Determination company data. Determines which registration masks to match when processing a transaction: either the current authority's masks or the current authority plus parent zone authorities. For example, Quebec enables both the Quebec Provincial masks as well as the Canadian Federal mask. |

-None- |

|

|

<XX> - <TRX_TYPE> Reverse Charge |

Determines whether a Buyer is eligible for a reverse charge based on a combination of Buyer and Seller registration and Seller establishment for all international jurisdictions. Determination first evaluates whether Reverse Charge (per transaction type) applies. If not, then Determination evaluates whether the seller can collect VAT. If Reverse Charge does not apply, the authority options associated with ability of the seller to collect VAT are evaluated (CR - Registration Required and DE - Domestic Establishment Only). When the Buyer must reverse charge VAT, the following results are returned:

If Reverse Charge does not apply, and the Seller is eligible to collect VAT, standard tax is returned. If the Seller is not eligible to collect, Determination returns the following results:

|

|

|

|

Tax Direction |

Determines whether or not tax direction processing is (VAT or VAT-like) or is not (Sales and Use Tax) used for this authority. |

-None- |

|

|

Triangulation Simplification |

Specifies what elements must be satisfied for the transaction to be eligible for Triangulation Simplification. In addition to country rules, allows custom settings for each country when a chain transaction may involve countries with conflicting rules. Each country in the chain:

|

-None- |

|

|

Turn Off Authority |

Determines whether or not this authority will ever be considered in tax calculations. The default for all authorities is to not set this value (the authority may be considered in tax calculations). |

-None- |

Yes: Turn off this authority. No tax amounts or any other data will be calculated or returned for this authority. No: Do not turn off this authority. the authority is turned on and will be evaluated. |

|

UE - Used and Enjoyed |

Under VAT law, in some cases, the place of use and enjoyment of a service can change the jurisdiction that has authority to charge VAT for the services. In the EU, the Use and Enjoyment provision applies only when there is a non-EU country involved in the supply:

For Determination, the place where the service is used and enjoyed must be the Supply Location. This authority option determines if a service is taxed in the Supply Location or the Buyer Primary Location. This authority option may need to be set to accommodate specific business needs. |

|

-None- |

|

United States Bracket System |

Flags whether or not an authority follows the US Bracket System logic. For more information, see Bracket Tax System. |

-None- |

|

|

Voluntary Use Tax Applied |

Voluntary Use Tax affects several authorities in the United States which have enacted use tax where the compliance is voluntary. |

-None- |

|

Test Authority Options in Workbench Scenarios

Example 1: Intra-company Settings

These two examples test settings of the Intra-Company Tax Free (IC) option.

|

Intra-Company Tax Free Option (IC) = True |

||||

|---|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Registration |

Tax Result |

|

Goods |

Ship From is the same as Ship To (Canada). |

Condition = None Value = Yes (within the date range). |

Registration number is the same for Buyer and Seller. |

NL (Not Liable). |

In this scenario, identical registrations is the clue that indicates that the transaction is intra-company. Determination checks to see where the Ship From and Ship To addresses are, and if the registration numbers are the same, concludes that the shipment is intra-company and thus no tax is calculated. Most countries allow an intra-company transfer to be a non-taxable event.

|

Intra-Company Tax Free Option (IC) = False |

||||

|---|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Registration |

Tax Result |

|

Goods |

Ship From is the same as Ship To (Canada). |

Condition = None Value = No(within the date range). |

Registration number is the same for Buyer and Seller. |

For the Invoice Date, the result is 5% GST. |

In this scenario, the settings are the same as the previous example except that the intra-company tax free option is set to No for a specific date. This scenario would be uncommon as it would be rare to tax an intra-company transaction.

Example 2: CR Registration Requirements

These two examples test settings of the Registration Required (CR) option.

|

Registration Required Authority Option (CR) = Required |

|||

|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Tax Result |

|

Goods |

Ship From is the same as Ship To (Singapore). |

|

No tax is calculated unless the Seller is registered in the authority. |

This is a sales transaction within Singapore. Sending an established authority gives the desired taxability without sending a registration number. You must set the establishment for the relevant parameter for the authority being considered. In this scenario, the Seller must be registered with the Singapore Authority in order to collect GST.

|

Registration Required Authority Option (CR) = Any |

|||

|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Tax Result |

|

Goods |

Ship From is the same as Ship To (Singapore) |

|

If the established authority is set to Singapore, GST will be calculated. |

As in the previous scenario, this is a sales transaction within Singapore. Both Ship From and Ship To are in Singapore. The CR condition is changed to Any and the establishment is evaluated in order to collect the GST. The establishment setting can be set on the Established Authorities tab or can be passed in through input XML.

Example 3: Reverse Charge

These examples test settings of the Reverse Charge (RC) option. In all of these scenarios, both Buyer and Seller are registered in Mexico and have different numbers. The DS Reverse Charge is set to Not Applicable/Not Applicable, so it is not on.

|

Reverse Charge (RC) Mexico = Not Applicable |

|||

|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Tax Result |

|

Default Services |

Ship From is the same as Ship To. |

|

The transaction is taxed as usual. |

Registrations are different, but the Ship To and Ship From are the same.

|

Reverse Charge (RC) Mexico = On |

|||

|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Tax Result |

|

Default Services |

Ship From is the same as Ship To. |

|

Recovery of reverse charge is from the Ship From location. |

Domestic condition is the crucial setting; if this were a different transaction type than Default Services, the calculation would be outside the authority of the option. Registration numbers are set but are different for buyer and seller.

|

Reverse Charge (RC) Mexico = On |

|||

|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Tax Result |

|

Default Services |

Ship From is the same as Ship To. |

|

Reverse tax will be in effect if the buyer is registered. |

Reverse charge applies because the buyer is registered and the seller is not established.

|

Reverse Charge (RC) Mexico = On |

|||

|---|---|---|---|

|

Transaction Type |

Shipping |

Condition/Value |

Tax Result |

|

Default Services |

Ship From = Seller |

|

Reverse charge applies because the Seller's establishment is set to Y. The recovery of the reverse charge is in the Ship From location. |

Buyer and Seller are both registered in Mexico and have different numbers. Reverse charge applies because the seller is established.