Cascading Rates and Fees

Menu > Tax Data > Authorities > Basic (Rules and Rates) > Cascading Rates

Cascading Rates and Fees enable you to quickly create a rule that applies to all authorities of common tax type at the same level in the Zone Tree, and then map that rule to the appropriate rate. The authorities must all share the same parent State or Country.

For example, you could create a cascading rule that applies to:

- All County Sales/Use Tax authorities in Colorado.

- All City Sales/Use Tax authorities in Alabama.

- All Local Sales/Use Tax authorities in California.

For more information, see Cascading Rules and Rates for Products.

Configuring Cascading Rates, Fees, and Rules

Configuration of Cascading Rates and Rules is similar to the process described for standard Rates and Rules, with the differences shown in the procedure below.

You can set up a cascading rate (or fee) that applies to different types of authorities within a state or country. For example, you could set up a 4% rate that cascades to all authorities (county, city, and local) in a particular state. If you do, be aware of the following effects:

- The county, city, and local rates of 4% are each applied if a matching authority is found at that level. The result is a total rate of up to 12%.

- Tier amounts are not passed from one authority to the next during calculation. Tier amounts are set to zero for each authority calculated in the transaction. In addition, if multiple rules call the same rate for an authority, each rule is evaluated independently with respect to tier amounts.

The typical use scenario is to specify an authority type when creating the cascading rule, resulting in a rate that applies to a transaction of that type (for example, all counties in a state). See Cascading Rules and Rates for Products for general information about how cascading rules and rates apply to any authority of the same authority type in the same state as the authority.

Using multiple cascading rates, you can apply different rates at different levels. You could, for example, specify different cascading rates for the county level (4%), city level (1%), and local level (.5%). When you set up individual cascading rules and rates, tier amounts are also calculated at each level independently, which is almost always the desired result.

Create Cascading Rates or Cascading Fees and Associated Cascading Rules

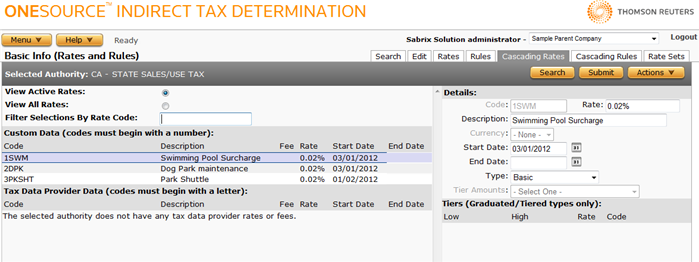

On the Rates and Rules page, the selected authority is shown, as well as data for rates and fees associated with the authority:

Use the Cascading Rate and Fee Codes Field Reference below to understand the data in the left pane that is associated with the selected authority.

- Navigate to the Authorities Search page, then select the desired Country or State authority. The rule may then be applied to that authority and its logical children. For example, you could select CO - STATE SALES TAX to configure a rate and rule to apply to Colorado counties.

- Click the Cascading Rates tab:

- Select Add Rate or Add Fee from the Actions menu.

- Configure the rate or fee using the field reference below. Repeat for as many rates or fees as you need.

- Click the Cascading Rules tab.

- Select Add Rule from the Actions menu and enter the rule as shown on the Cascading Rules page. You must select the desired Authority Type you want the rule to apply to. For example, County Sales/Use. Repeat for as many rules as you need.

|

Cascading Rate and Fee Codes Field Reference (left pane) |

|

|---|---|

|

Field |

Description |

|

View Active Rates View All Rates |

Specifies if you want to view only active rates or all rates. Default is Active Rates. A rate is considered Active if it has a start date less than or equal to the current date and an end date greater than or equal to the current date. |

|

Code |

A short code used to refer to the rate or fee, such as SR for Sales and Use Rate. |

|

Description |

A description of the rate or fee, such as Sales and Use Rate. |

|

Fee |

The actual fee amount. For tiered fees, Tier will be displayed; for graduated fees, Grad will be displayed. |

|

Rate |

The actual rate expressed as a percentage. For tiered rates, Tier will be displayed; for graduated rates, Grad will be displayed. |

|

Use Default Input UOM |

This checkbox only appears when configuring fees. If checked, indicates that the default quantity and unit of measure identified in the Input XML or the default unit of measure listed on the Authority will be used:

If unchecked, the following process takes place:

For more information, see Units of Measure Conversion. |

|

Unit of Measure |

This menu only appears when configuring fees. If the Use Default Input UOM is not checked, selecting a Unit of Measure here enables its use if a default is not specified by the input XML or by the authority. For more information, see Units of Measure Conversion. |

|

Currency |

Specify a currency for use with invoice or item amount tiers when using graduated or tiered rates or fees. You can specify a currency when setting a rate or fee. |

|

Start Date |

The date (MM/DD/YYYY) on which the rate or fee becomes active. |

|

End Date |

The date (MM/DD/YYYY) on which the rate or fee terminates. If you do not enter a value here, the rate or fee will remain effective indefinitely. |

Additional tasks

Click a link to go to instructions for completing additional tasks. Use the field reference tables (Cascading Rate and Fee Details and Cascading Rate and Fee Tiers ) below to enter data in required and optional fields:

Tiers cannot overlap each other. Also, if you will be entering multiple tiers, add the highest tier first, then the next highest, and so on. For example, if you will enter tiers of 1-99, 100-499, and 500-2000, add the 500- 2000 tier first, then 100-499, then 1-99.

- Select the rate or fee for which you want to add a tier, by clicking it in the rate list.

- Select a tier type from the Tier Amounts pull-down menu.

- Select Add Tier from the Actions menu.

- Enter a Low amount, a High amount for the tier.

- Add one, but not both, of the following:

- A Rate or Fee.

- A Code.

- Click Find to view a list of valid codes you can select or enter. If you enter an invalid code, an error message appears.

- Click Submit to save the tier.

- Select a rate or fee from the code list.

- Edit the item's details, using the field reference below.

- Click Submit to save your changes.

- Select the rate or fee containing the tier from the code list.

- Select a tier from the tier list.

- Edit the tier's details.

- Click Submit to save your changes.

Before deleting a cascading rate or fee, you must delete all data that references the rate or fee. If such data exists, Determination presents a dialog box indicating that you must delete the dependent data first. Do so, then re-attempt to delete the item.

- Select the rate you want to delete.

- Select Delete Rate from the Actions menu.

- Click OK to confirm the deletion.

Before deleting a cascading rate or fee, you must delete all data that references the rate or fee. If such data exists, Determination presents a dialog box indicating that you must delete the dependent data first. Do so, then re-attempt to delete the item.

- Select the fee you want to delete.

- Select Delete Fee from the Actions menu.

- Click OK to confirm the deletion.

- Select the tier you want to delete.

- Select Delete Tier from the Actions menu.

- Click OK to confirm the deletion.

Export cascading rate or fee data

The Export option is only available for Cascading Rules associated with Tax Data Provider authorities. To export Rule(s) associated with a Custom Authority, export the entire authority.

- Select the rate or fee you want to export.

- Select Rate Properties or Fee Properties from the Actions menu.

- Click one of the following:

- This Rate or This Fee to export only the selected item (and associated tier information, if appropriate).

- This Rate and All Siblings or This Fee and All Siblings to export the selected item and all other custom cascading rates or fees (and custom cascading rates or fees) associated with the selected authority. All associated tier information is also included.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

|

Cascading Rate and Fee Details Field Reference (right pane) |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Code |

Y |

The code for this rate or fee. For custom rates or fees, this value must be numeric. |

|

Fee |

Y |

The fee amount. Fees over 10 decimal places are rounded and saved to the 10th place. Fees 10 decimal places and under are not rounded. |

|

Rate |

Y |

The rate expressed as a percentage. Enter a percentage including up to 8 decimal places. Simple example: Enter 5.25 for a rate of 5.25%; this is stored in ONESOURCE Indirect Tax Determination as .0525. Maximum length example: 50.00000025 = 50.00000025%, which is stored in ONESOURCE Indirect Tax Determination as .5000000025. |

|

Description |

Opt. |

A description of the rate. |

|

Currency |

Opt. |

Specifies a currency for use with invoice or item amount. You can specify a currency when setting a rate or fee. By default, if a currency is defined for a rate or fee and no conversion for the specified currency exists, Determination applies a 1:1 conversion and returns the appropriate fee/tax result. For more information, see Currency Specs. |

|

Start Date |

Y |

The date (MM/DD/YYYY) on which the rate becomes active. |

|

End Date |

Opt. |

The date (MM/DD/YYYY) on which the rate terminates. If you do not enter a value here, the rate will remain effective indefinitely. |

|

Y |

Choose one:

|

|

|

Tier Amounts |

Y |

Choose one:

If you specify an invoice or item amount for either a graduated or tiered rate or fee, the amount applies to any currency used in the transaction. For example, a tier of 1-99 would apply to US dollars, Canadian dollars, Mexican pesos, or whichever currency is used in the transaction. Currency conversion is not used to determine which graduated rate, fee, or tier to use. |

|

Cascading Rate and Fee Tiers Field Reference (tiered only) |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Low |

Y |

The low boundary for the tier. See Tier Amounts above. |

|

High |

Opt. |

The upper boundary for the tier. See Tier Amounts above. |

|

Fee |

Y |

The actual fee amount. Fees over 10 decimal places will be rounded and saved to the 10th place. Fees 10 decimal places and under are not rounded. |

|

Rate |

Y |

The actual rate expressed as a percentage. Enter a percentage up to eight decimal places. For example, 50.25 = 50.25%. You can use either the Rate or Code fields to specify the rate. |

|

Code |

Y |

A predefined code associated with the authority that contains the actual rate or fee. Any code entered or selected must be a basic, not tiered or graduated, rate or fee. Click Find to view a list of selectable codes. |