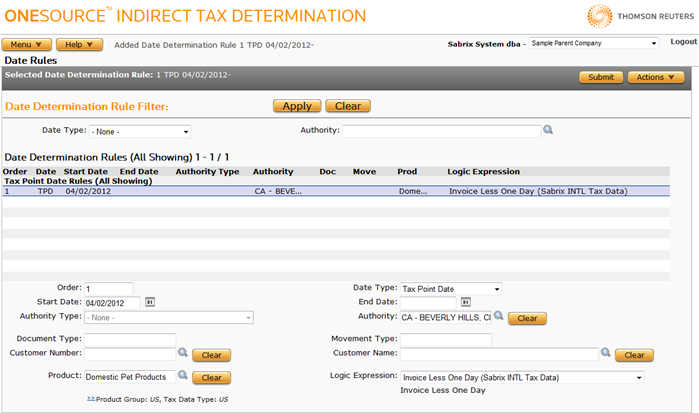

Date Rules

Menu > Tax Data > Date Determination > Date Rules

Use this page to view or specify rules that map Date Logic to transaction criteria. When date determination logic is applied to a transaction, it can affect the Tax Determination Date, Tax Exchange Rate Date, and Tax Point Date for a transaction.

Before using this page for the first time, please review Date Determination.

Date Rule Matching

Rules are applied if all input XML transaction data match the values found on a rule. Matches are subject to the following conditions:

- The Invoice Date or Movement Date must fall within the rule's validity period.

- Any Authority Type, Authority, or Document Type specified in the transaction must match.

- A Movement Type must match either that specified for the Invoice or Line item, with precedence given to the Line item.

- A Customer is matched with any provided Number taking precedence over Customer Name, and with Line data taking precedence over Invoice data.

- A Product Category can be matched by any of the following means: direct match, parent product match, commodity code match, or parent commodity code match.

Using the Date Rules Page

This page has the following areas and associated tasks:

- Date Determination Rule Filter: Filter the list of date determination rules based on Date Type or Authority Name.

- Date Determination Rule List: View and select from a list of currently configured rules.

- Selected Date Determination Rule Tasks : Procedures to manage the selected rule. Click a link to go to the procedure:

Date Determination Rule Filter

Use this section to filter the Date Determination Rules List by Date Type, Authority Name, or both.

Enter or select your desired filter data using the field reference below, then click Apply.

|

Date Determination Rule Filter Field Reference |

|

|---|---|

|

Date Type |

A date type on which to filter. One of the following:

For a description of these date types, see Date Determination. |

|

Authority |

A single authority on which to filter the results. You can:

|

Date Determination Rule List

The Date Determination Rules List is the complete list of rules currently configured which are accessible to your company. These include custom rules (1-4999) and Tax Data Provider rules (5000-9999).

If you select a rule from the list, the Selected Date Determination Rule section is populated with the data related to that expression.

For a detailed list of field contents, see the table at the end of this topic.

Selected Date Determination Rule Tasks

You can use this section to either create a new date determination rule or modify or delete the selected rule. Only rules owned by your company can be modified or deleted.

Use the Date Determination Rules Field Reference below to enter data in required and optional fields.

Add a new date determination rule

- Select Add from the Actions menu.

- Enter data using the field reference below.

- Click Submit to save your changes.

Modify a date determination rule

- Select the item from the list.

- Modify data using the field reference below.

- Click Submit to save your changes.

Copy a date determination rule

You can use Copy to quickly create a Date Determination Rule that applies to all three date types. Create the initial rule for one date type, then and copy it twice to the other two date types.

- Select the item from the list.

- Select Copy from the Actions menu.

- Modify data using the field reference below.

- Click Submit to save your changes.

Delete a date determination rule

- Select the item from the list.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

Export a date determination rule

You can export the selected date determination rule, or all date determination rules owned by this company

- Select Properties from the Actions menu.

- Click one of the following.

- This Date Determination Rule to export only the selected date determination rule.

- This Date Determination Rule and All Siblings to export all date determination rules owned by this company.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

|

Date Determination Rules Field Reference |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Order |

Y |

The rule order. Rules are processed from low to high. If you are not a Tax Data Provider company, enter a rule from 1-4999. If you are a Tax Data Provider company, enter a rule from 5000-9999. |

|

Date Type |

Y |

One of the following:

For a description of these date types, see Date Determination. |

|

Start Date |

Y |

The date (MM/DD/YYYY) on which the rule becomes active. |

|

End Date |

Opt. |

The date (MM/DD/YYYY) on which the rule terminates. If blank, the rule will remain effective indefinitely. |

|

Authority Type |

Y |

One of the configured Authority Types. The list presented here is dependent on whether your company is a Tax Data Provider, a Custom Data Provider, or a Child (non-Data Provider) Company. TDP companies can select only those authorities they own, while CDP and Child companies can select owned and inherited Authority Types. Default is None. |

|

Authority |

Opt. |

The authority name to which the rule applies. |

|

Document Type (Doc in Rules List) |

Opt. |

The document type. |

|

Movement Type (Move in Rules List) |

Opt. |

The movement type. |

|

Product (Prod in Rules List) |

Opt. |

The product for which the date determination rule applies. You can click the Product Filter link below this field to display a pop-up tool which enables you to filter the list of available products based on the specified Product Group and Tax Data Type. |

|

Customer Name |

Opt. |

The customer name. Does not appear in the Rules List. Customer Number takes precedence over Customer Name if both are present. |

|

Customer Number |

Opt. |

The customer number. Does not appear in the Rules List. Customer Number takes precedence over Customer Name if both are present. |

|

Logic Expression |

Y |

One of the named Date Determination Logic Expressions. See Date Logic. |