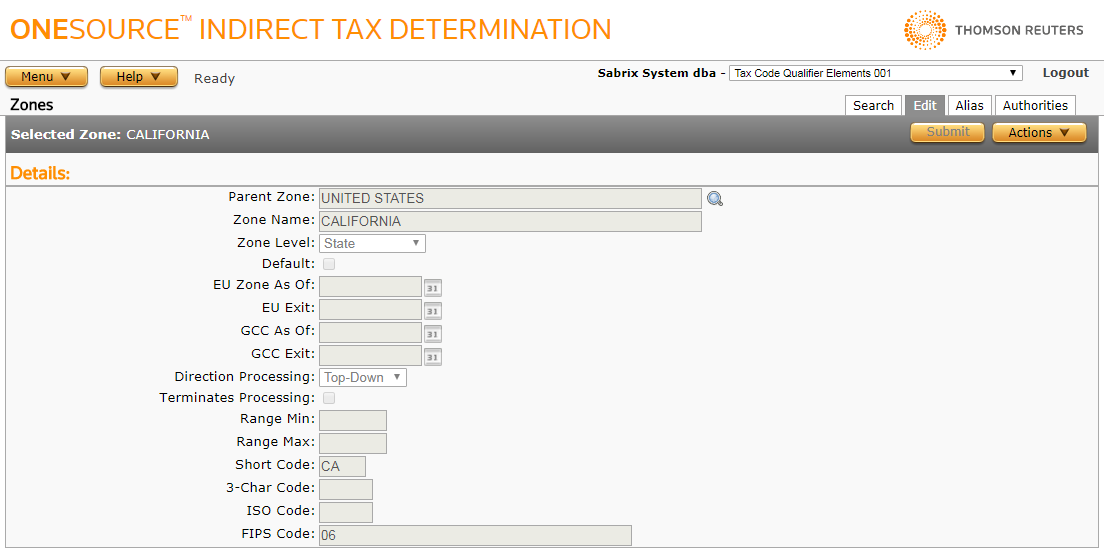

Edit Zones

Menu > Tax Data > Zones > Edit

Use this page to define a zone and how it functions. By default, this page displays data from the zone selected on the Search Zones page. If you selected Add from the Search Zones page or from this page, a blank page is displayed instead.

Before working with this page the first time, please review Zones.

Use the Edit Zones Field Reference below to enter data in required and optional fields.

Add a zone

- Select Add from the Actions menu.

- Enter or select zone data using the field reference below.

- Click Submit to save your changes.

Edit a zone

- Enter or select zone data using the field reference below.

- Click Submit to save your changes.

|

Edit Zones Field Reference |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Parent Zone |

Y |

The parent of this zone.

|

|

Zone Name |

Y |

The name of this zone. If the Zone Level is Geocode, this field is not selectable and is populated with the Range Min – Range Max values from below. |

|

Zone Level |

Y |

The level of this zone. |

|

Default |

Opt. |

For US transactions, makes this zone the default zone of this name at the City or Post Code (ZIP Code) level. For example, multiple ZIP Codes of 97221 might exist in a zone tree; one in Multnomah County and one in Washington County. Selecting the 97221 zone that is a child of Multnomah County as the default ensures that transactions passed with only that ZIP Code (and no City/County data) are assumed to be in Multnomah, not Washington, county. |

|

EU Zone As Of |

Opt. |

Determines whether special EU jurisdiction logic is used for this zone. If a date is entered in this field, transactions submitted with an effective date of that date or later will use EU jurisdiction logic. |

|

EU Exit |

Opt. |

Determines the end date (MM/DD/YYYY) for when special EU jurisdiction logic no longer applies. |

|

GCC As Of |

Opt. |

Determines whether GCC jurisdiction logic is used for this zone. If a date is entered in this field, transactions submitted with an effective date of that date or later will use GCC jurisdiction logic. |

|

GCC Exit |

Opt. |

Determines the end date (MM/DD/YYYY) for when GCC jurisdiction logic no longer applies. |

|

Direction Processing |

Opt. |

This field triggers reverse processing. Reverse processing means that taxes are calculated first on the bottom level (for example, a city) and then on up to the selected zone level (for example, a country). Normal processing means that taxes are calculated first on the top level and then proceeds to the bottom level. This affects Tax on Previous Tax and it also impacts the selection of tax authorities when used in tandem with the process terminator. If any zone in a zone tree is flagged for reverse processing, all zones in that tree will use reverse processing. |

|

Terminates Processing |

Opt. |

This field indicates that this zone terminates the authority processing during tax calculation. If selected, this zone will be the last one processed on transactions that involve this zone. For example, if in Ontario this field was selected (and reverse processing were on for Canada) the Ontario tax authority would be used and the Canada level tax authority would not be used. If this flag were not selected then both the Ontario and Canada tax authorities would be applied to the transaction. |

|

Range Min |

Opt. |

The lowest Geocode in a Geocode range. Entering a value here populates the first half of a Geocode range. |

|

Range Max |

Opt. |

The highest Geocode in a Geocode range. Entering a value here populates the second half of a Geocode range. |

|

Short Code |

Opt. |

A one-character or two-character code for the zone. |

|

3-Char Code |

Opt. |

A three-character code for the zone. |

|

ISO Code |

Opt. |

An ISO (International Standards Organization) code for the zone. |

|

FIPS Code |

Opt. |

A FIPS (Federal Information Standards for Processing) code for the zone. |