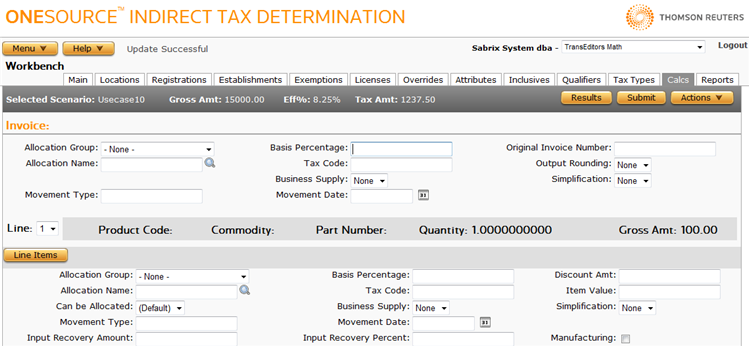

Workbench Calcs

Menu > Workbench > Calcs

Use this page to set tax calculation options for this scenario. Use the Workbench Calc Options Field Reference below to enter data in procedures.

Set invoice-level options

- Enter or select the desired values.

- Click Submit to save the options.

Set line-level options

- Click the Line Items button if necessary. This button does not appear if you are already in line configuration mode.

- Select the desired line by choosing a number from the Line menu. If you need to see details about a line, you can toggle back and forth by clicking the Line Items and Line Data buttons.

- Enter or select the desired values.

- Click Submit to save the options.

View XML data

- Navigate to the Actions menu.

- Select XML Input, Allocated XML Input, Filtered XML Input, or XML Output. For more information, see Viewing Workbench XML Data.

Export a scenario

You can export the selected scenario, or all scenarios associated with this company:

- Select Properties from the Actions menu.

- Click one of the following:

- This Scenario to export only the selected scenario.

- This Scenario and All Siblings to export the selected scenario and all other scenarios associated with the selected company.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

View calculation details

- Click Submit to save your scenario.

- Then click Results in the Selected Scenario section.

|

Allocation Group |

The allocation group to apply to this transaction, at either the invoice or line level. |

|

Allocation Name |

The allocation name to apply to this transaction, at either the invoice or line level. Click the Find icon to view allocations associated with the selected Allocation Group. |

|

Basis Percentage |

A percentage of the gross amount used in tax calculation. Enter a percentage to 10 decimal places. For example, 50.25 = 50.25%. Basis percentage can be applied to a transaction through input XML, an exemption certificate, or a rule, in that order of precedence (input XML always overrides certificate data, which overrides rule data). |

|

Business Supply |

Indicates that a supply is being used for business. For some transaction types, whether a supply is being used for business or not impacts the tax and reporting requirements of the buyer and the seller. Can be used to indicate if a transaction is a Business-to-Business Supply (B2B) or Business-to-Consumer (B2C). The default None and Yes represent B2B. No represents B2C. |

|

Can be Allocated (Line Only) |

Indicates whether an allocation can be applied to this line. The value here overrides an allocation processing that may be set at the invoice level, or for other lines. The default setting inherits allocation data from the invoice level. |

|

Discount Amt (Line Only) |

In some situations volume or other discounts must be taken into account when calculating tax. For these situations, Discount Amount can be used to indicate how much the Gross Amount has been discounted by. |

|

Input Recovery Amount (Line Only) |

The input recovery amount (used in VAT calculations) to apply to the line. If an amount is specified, do not enter an Input Recovery Percent. |

|

Input Recovery Percent (Line Only) |

The input recovery percentage (used in VAT calculations) to apply to the line. If an amount is specified, do not enter an Input Recovery Percent. |

|

Item Value (Line Only) |

The total value of all items on this line. This is distinct from the Gross Amount because it does not contain costs such as landed costs, insurance, freight and other associated costs that Gross Amount does contain. If an Item Value is present in a transaction, it overrides any Gross Amount found in the transaction. Item Value is used in many VAT and EU Intrastat reports. |

|

Manufacturing (Line Only) |

When checked, indicates that the goods or services are for manufacturing purposes. |

|

Movement Type |

A customer-defined movement type. |

|

Movement Date |

An optional date on which the movement occurred. If Movement Date is not defined, the transaction defaults to the Invoice Date for determining tax calculations. For more information, see Date Determination. |

|

Original Invoice Number (Invoice Only) |

This number enables a credit invoice to be associated with an original invoice in the audit tables for reporting purposes. |

|

Output Rounding (Invoice Only) |

When set to N, un-rounded amounts are returned for all <*AMOUNT> elements (such as <TAX_AMOUNT> in the <TAX> block, including in elements which usually contain rounded results. When set to Y (or None), the <*AMOUNT> structures in the Output XML are populated by rounded results or un-rounded results as appropriate for their type. For example, when set to N, the <TAX_AMOUNT>.<DOCUMENT_AMOUNT> element will always contain an un-rounded result. When set to Y, this element will always contain a rounded result. |

|

Simplification |

Indicates whether or not to override any triangulation simplification performed by the Universal Tax Engine. Choices are None (do not override the tax engine), Yes (provide triangulation simplification), and No (do not provide triangulation simplification). For more information, see Triangulation Simplification. |

|

Tax Code |

A code that enables special tax processing; defined on an Authority's Rules page. |