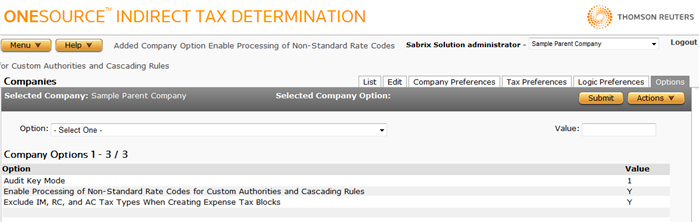

Company Options

Menu > System > Companies > Options

Use this page to specify company options for the selected company. Before using this page for the first time, please review Companies.

This tab is not available when you select a company with a type of Tenant.

Use the reference tables below to enter required and optional data in the fields.

Set a company option

- Select Add from the Actions menu.

- Select an option from the Option menu.

- Enter a Value for the option.

- Click Submit to save your changes.

Modify a company option

- Select an option from the Company Options list.

- Enter a new Value for the option.

Delete a company option

- Select an option from the Company Options list.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

|

Company Options Field Reference |

||

|---|---|---|

|

Option |

Y |

Available options to set for your company. See the Supported Options table below for explanations of each option. |

|

Value |

Y |

The value of the selected option. |

Available Company Options

Parameters that can be set on the Company Options page are listed in the following table.

Many of the options below can be set for all companies. If both the company option and the configuration parameter are set, the company option takes precedence. For more information, see Configuration.

|

Supported Options |

||

|---|---|---|

|

Option |

Req? |

Description |

|

Address Validation Mode |

N/A |

This option is reserved for future use. |

|

Allow US Addresses Without Country Of US |

Opt. |

Determines the behavior used if a country is not specified within an address. For example, if a transaction includes a ship to address with Washington for the state and 98101 for the zip code, but does not include a value for the country. If set to Y, Determination will use US (United States) as the country for any addresses where the country element is not specified but other elements are specified. If set to N (default), a country must be specified for any addresses where other elements are specified. Otherwise, the transaction will fail. This parameter applies to all address types:

|

|

Audit Address Data Used In Transactions |

Y |

Set to Y (default) to enable writing of address data to the audit database. If set to any other value or blank, address data is not stored in audit. You must keep this value set to Y if you want to see addresses in ONESOURCE Indirect Tax Reporting. |

|

Audit Address Validation Messages |

Opt. |

Set to Y to enable writing of address validation messages to the audit database. If set to any other value or left blank (default), messages are not stored in audit. |

|

Audit All Messages Regardless Of Type And Severity |

Opt. |

Set to Y to allow auditing of all messages regardless of the company message threshold setting. Default setting is blank (off) which means that not all messages from invoices are available for audit. For more information, see Messages. |

|

Audit Allocation Actions Applied To Transactions |

Opt. |

Set to Y to enable writing of allocation actions to the audit database. If set to any other value or blank (default), allocation actions are not stored in audit. |

|

Audit Authority Attributes Used In Transactions |

Opt. |

Set to Y to enable writing of authority attributes to the audit database. If set to any other value or blank (default), authority attributes are not stored in audit. In Determination, Authority Attributes are generated from the Rule Output as defined on the authority rule. Name and Value are entered for selected rules on the Rule Output pages for Rules and Cascading Rules. This information is returned in the XML Output. |

|

Audit Authority Types Returned In Transactions |

Opt. |

Set to Y to enable writing of authority types to the audit database. If set to any other value or blank (default), authority types are not stored in audit. |

|

Audit Calculation Messages |

Opt. |

Set to Y to enable writing of calculation messages to the audit database. If set to any other value or blank (default), messages are not stored in audit. |

|

Audit End Uses Applied To Transactions |

Opt. |

Set to Y to enable writing of end use data to the audit database. If set to any other value or blank (default), end use data is not stored in audit. |

|

Audit Internal Messages |

Opt. |

Set to Y to enable writing of internal messages to the audit database. If set to any other value or blank (default), messages are not stored in audit. |

|

Audit Invoice Validation Messages |

Opt. |

Set to Y to enable writing of invoice validation messages to the audit database. If set to any other value or blank (default), messages are not stored in audit. |

|

Audit Jurisdiction Determination Messages |

Opt. |

Set to Y to enable writing of jurisdiction determination messages to the audit database. If set to any other value or blank (default), messages are not stored in audit. |

|

Audit Key Mode |

Opt. |

Used for searching for existing records before inserting a record. The setting is only applicable if the Configuration parameter PESSIMISTIC_AUDIT_DATA_SAVE is set to 1. This option overrides the AUDIT_KEY_MODE parameter setting. Set to 0 to disable. |

|

Audit Licenses Applied To Transactions |

Opt. |

Set to Y to enable writing of licenses to the audit database. If set to any other value or blank (default), licenses are not stored in audit. |

|

Audit Servlet Messages |

Opt. |

Set to Y to enable writing of servlet messages to the audit database. If set to any other value or blank (default), messages are not stored in audit. |

|

Audit Transeditor Actions Applied To Transactions |

Opt. |

Set to Y to enable writing of TransEditor actions to the audit database. If set to any other value or blank (default), TransEditor actions are not stored in audit. |

|

Audit User Interface Messages |

Opt. |

Set to Y to enable writing of user interface messages to the audit database. If set to any other value or blank (default), messages are not stored in audit. |

|

Calc Dir R: Populate Gross Amount With Calculated Amount |

Opt. |

This flag is used in conjunction with reverse-from-tax transactions:

Although this flag affects the gross amount value returned in the XML output, it has no effect on the audit data, which still contains records for both the calculated gross amount and the gross amount (if you provided it). |

|

Calc Dir T: Populate Gross Amount With Calculated Amount |

Opt. |

This flag is used in conjunction with reverse-from-total transactions:

Although this flag affects the gross amount value returned in the XML output, it has no effect on the audit data, which still contains records for both the calculated gross amount and the gross amount (if you provided it). |

|

Company Roles For Document Rounding |

Opt. |

Specify the role of Seller, Buyer, Middleman, or any combination of these roles for use with document rounding. This option may be set at the company level to control the applicability of document rounding based on the company role established on the transaction. If this option is not established, document rounding will apply to all company roles. This option may be used, for example, when document rounding is applicable to a transaction that uses Seller as the Company Role. This option prevents the application of document rounding to transactions that include the Company Role of Buyer and avoids a discrepancy in some cases between the transaction tax record in the ERP General Ledger and the Determination audit database. |

|

Determine Date Types Used For Movement Date |

Opt. |

This configuration parameter specifies the default behavior to be used if date determination logic and rules are not used to specify the Tax Determination Date, Tax Exchange Rate Date, and Tax Point Date. If set to Y, then Determination would use the first available date from the following list:

If set to N (default) or left blank, Invoice Date is used to specify these dates in the absence of applicable date determination logic and rules. |

|

Enable Processing of Non-Standard Rate Codes For Custom Authorities And Cascading Rules |

Opt. |

Some fees authorities and food and beverage authorities do not use standard rate codes (CU, SU, or ST). In those cases, they use a no-tax rule to prevent tax assessment when not applicable and to prevent application of default state cascading tax rules. This option checks custom cascading rules to determine if the rule being processed is a custom cascading rule or if the authority being processed is a custom authority.

|

|

Enables Simple Registrations Such As DE Rather Than Full Number |

Opt. |

If set to Y, use the Simple Registration Mask for Authorities instead of the standard Registration Mask for validating Registrations. Simple Registration Masks can be passed in and used in tax calculations, but cannot be entered on the Registrations page. |

|

EU Place Of Supply Tax Handling |

Seller Country |

Specifies which tax result is returned in XML output for invoice printing, audit, and reporting purposes. For example, VAT rules include a Reverse Charge provision: VAT on B2B, cross-border supply of services (i.e., Buyer and Seller in different EU countries) is self-assessed by the Buyer. By default, the seller country tax result is returned. If this result meets your needs, this company option is not needed. For more information, see Evaluating B2B and B2C in Place of Supply of Services. Parameter values are:

To set this behavior system-wide, use the configuration parameter PLACE_OF_SUPPLY_HANDLING. For more information, see Configuration. If you use SAP or Oracle as your ERP system, do not use the BOTH value with the EU Place of Supply Handling company option. Use only the SELLER_LOCATION or BUYER_LOCATION values. |

|

Evaluate International Custom Authorities Past Zone Termination |

Opt. |

For non-US custom authorities, this setting overrides bottom-up terminates processing behavior in the zone tree.

To set this behavior system-wide, see Configuration. For more information, see Custom Authorities Associated with Bottom‑up/Terminate Zones. |

|

Evaluate US Custom Authorities Past Zone Termination |

Opt. |

For US custom authorities, this setting overrides bottom-up terminates processing behavior in the zone tree.

To set this behavior system-wide, see Configuration. For more information, see Custom Authorities Associated with Bottom‑up/Terminate Zones. |

|

Exclude 0% Non-Recoverable Tax Block |

Opt. |

Allows exclusion of the zero tax block in cases where the recoverability is 0%. In this case, the recoverable tax block would contain only superfluous data. Setting specifies how to treat the non-recoverable tax block in data sent to the ERP:

|

|

Exclude IM, RC, And AC Tax Types When Creating Expense Tax Blocks |

Opt. |

Determines whether or not to exclude the tax types IM (Import), RC (Reverse Charge), and AC (Acquisition) when determining if an Expense Tax block is created. See "Post VAT Non-Recoverable Amounts," below. Valid settings are Y (do not create an Expense Tax block when the tax type is IM, RC, or AC) or N (create the NR tax block for all tax types). If this option is not set, Determination defaults to Y. |

|

Gather Invoice Tax Summaries |

Opt. |

Consolidates data from the TB_INVOICES table for non-taxable basis, exempt amount, and tax rate. To set this behavior system-wide, use the configuration parameter GATHER_INVOICE_TAX_SUMMARIES. For more information, see Configuration and Tax Summary |

|

Include International Custom Authorities Past Terminate Processing Zones |

Opt. |

For international custom authorities, this settings tells Determination whether to include custom authorities for consideration in tax calculations if it finds them above the termination zone.

This only works in combination with other settings. For more information, see Custom Authorities Associated with Bottom‑up/Terminate Zones. |

|

Include US Custom Authorities Past Terminate Processing Zones |

Opt. |

For US custom authorities, this settings tells Determination whether to include custom authorities for consideration in tax calculations if it finds them above the termination zone.

This only works in combination with other settings. For more information, see Custom Authorities Associated with Bottom‑up/Terminate Zones. |

|

Match Customers Based On Number, Name, Or Both |

Y |

If not present or set to Y (default), customer lookups are based on the value of the input XML element <CUSTOMER_NUMBER> only (ignoring <CUSTOMER_NAME>). If set to N, the value of <CUSTOMER NAME> is considered as well. In this case:

|

|

Override Bottom Up Termination For Custom Authority Type |

Opt. |

For US custom authorities, this setting overrides bottom-up terminates processing behavior in the zone tree.

For more information, see Custom Authorities Associated with Bottom‑up/Terminate Zones. |

|

Post VAT |

Opt. |

Determines whether or not to create an Expense Tax block in the output XML for the purpose of GL reconciliation when the Input Recoverability specified by the rule applied to a transaction is less than 100 percent. Valid settings are Y (default) (create an Expense Tax block) or N (do not create an expense tax block). For more information, see VAT Recoverability. |

|

Return Zero Rate For Exempt Transactions |

Opt. |

This parameter sets the <TAX_RATE> returned in a transaction that has been exempted due to an exempt customer or certificate.

|

|

Save Input XML To Audit Database |

Opt. |

When set to Y, Input XML submitted with a transaction is stored in the Audit Database along with the calculation results. If set to N or left blank, Input XML is not saved to the Audit Database. Regardless of the setting of this field, the result of a reversal is always blank. |

|

Select Authority Rule By Commodity Code |

Opt. |

Selects behavior for matching a product code.

For example, the following product codes may be evaluated:

The line item with the product code 81111201 uses Rule #2 because it is a closer match rather than Custom Rule #1. To set this behavior system-wide,use the configuration parameter RULE_SELECTION_BY_COMMODITY_CODE. For more information, see Configuration. |

|

Set Hierarchy Delimiter For Product/Exemption Imports |

Opt. |

Specifies the single-character delimiter to be used when specifying product category, product zone, and exemption certificate zone hierarchies using Import/Export import format. The default is a period (.). Other valid values are: > ? / @ # % ^ & * ( ) + |

|

Turn On Establishment For All INTL Authorities |

Opt. |

This parameter sets establishment status for those international zones and authorities that have not previously been configured on the Established Authorities pages.

When new authorities and zones are imported into Determination through Content Updates, they inherit the default set here. You can then modify the establishment status for individual zones and authorities on the Established Authorities Zones pages. |

|

Turn On Establishment For All US Authorities |

Opt. |

This parameter sets establishment status for those US zones and authorities that have not previously been configured on the Established Authorities pages.

When new authorities and zones are imported into Determination through Content Updates, they inherit the default set here. You can then modify the establishment status for individual zones and authorities on the Established Authorities Zones pages. |

|

Use Business Supply Flag For B2B Determination |

Opt. |

Set the Business Supply flag to indicate B2B or B2C instead of VAT registration for supply of services in the EU. If enabled, a sell-side transaction is treated as B2C if the Business Supply flag is set to No. If the Business Supply flag is set to None (default) or Yes, the transaction is treated as B2B. The absence of Buyer registrations automatically causes ONESOURCE Indirect Tax Determination to treat the transaction as B2C, unless the company configuration is enabled to override the registration criteria, in which case the Business Supply flag is required. For more information, see Evaluating B2B and B2C in Place of Supply of Services. |

|

Use Post Version 5.1.1 Tax Types |

Opt. |

Allows implementation of tax types added after Version 5.1.1 for EU Buyer Services:

Available values are:

|