Companies

You set up Companies to organize transaction and audit data, create B2B relationships, and share tax configurations and other data.

Your Determination implementation must have at least two companies: a transacting company (your company) and one or more Tax Data Providers from which the transacting company obtains its zone, authority, rule, rate, and other tax data. A typical implementation may have a transacting company, an International Tax Data Provider, and a US Tax Data Provider.

You can create as many companies as needed to fulfill your business requirements. You can create:

- Separate companies based on corporate divisions, geographies, or for any other reason. You can maintain separate custom data for each, and report on each company's audit data individually.

- A parent company whose purpose is to maintain master data that is shared among child transacting companies. For example, a parent company can be an organizational convention that is not a real company, but is used to define child companies (legal entities).

If you want to share data across companies, it is usually a good practice to have a parent company at the top of the structure as an organizational convention. Using this practice, each child company inherits the data set up in the parent company.

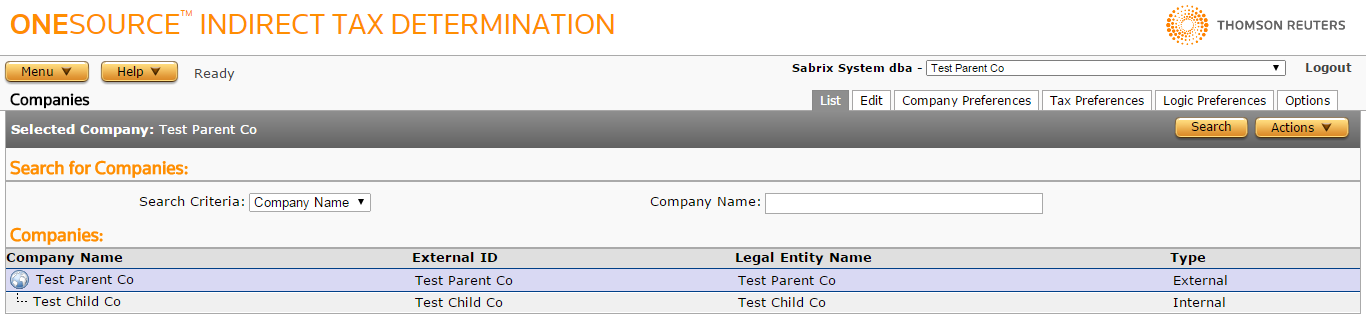

The Companies Hierarchy

You can view the Companies hierarchy on the List Companies page.

- Administration is the top-level company. All other companies are descendants of Administration.

- The next level in the hierarchy contains Tax Data Providers and Top-Level companies at your implementation.

- Each Top-Level company may have children that can share data from their parent if so configured.

When you create a company, create it as a child of the company whose company data you want to share. For example, you might specify that Sample Child US is a child of Sample Parent Company so that Sample Child US can obtain Product Mapping, Established Authority, and other company data from Sample Parent Company.

Data Owned and Shared by a Company

Each company owns, inherits, and optionally shares data based on the configuration of Data Providers. See Data Providers - Tax, Custom, and Others for a description of the data types that can be inherited and shared based on Company, Tax, and Logic Preferences.

Company Tasks

You can navigate to the Company tasks using the tabs in the Companies page.

Only the Edit tab is available when a company with a type of Tenant is selected.

- Show a hierarchical list of companies and view basic information about each company.

- Add a new company. This opens a blank Edit Companies page.

- Export one or more companies.

- Select a company to enable the other company configuration pages, including Edit Companies.

- Add new companies.

- Add or modify company data, including short name, legal name, parent (if any), and default home page.

- Activate or deactivate a company. When you deactivate a company, any transactions that reference the company or its data are not processed.

- Enable and configure B2B functionality.

- Enable and configure exemption certificate functionality.

- Specify US and International tax data providers.

- Select tax data provider inheritance from ancestor companies.

- Select established authority, registration, product mapping, and custom product inheritance from ancestor companies.

- Configure European Union Mini One-Stop Shop (MOSS) authority elections.

- Set message preferences.

- Specify your default XML Output and TransEditor groups.

- Configure options for company-specific application behavior.