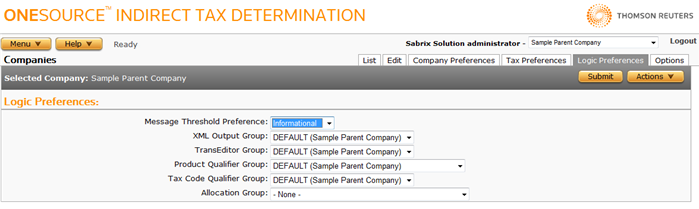

Company Logic Preferences

Menu > System > Companies > Logic Preferences

Use this page to specify message preferences and active XML Output and TransEditor groups for the selected company.

Before using this page for the first time, please review Companies.

This tab is not available when you select a company with a type of Tenant.

Use the Logic Preferences Field Reference below to add required and optional data.

Set company preferences

- Select the desired options.

- Click Submit to save your changes.

Export a company

You can export the selected company, or the company and all of its child companies. You cannot export the Administration company.

- Select Properties from the Actions menu.

- Click one of the following:

- This Company to export the selected company and all of its child companies.

- This Company Without Children to export only the selected company.

- This Company to export the selected company and all of its child companies.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

|

Logic Preferences Field Reference |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Message Threshold Preference |

Y |

This field limits the messages returned by ONESOURCE Indirect Tax Determination

in its output XML. Choices are Informational (Default), Warning and Severe. If Informational is selected, all messages appear. If Warning is selected, only Warning and Severe messages are returned. If Severe is selected, only Severe messages are returned. For more information, see Messages. |

|

XML Output Group |

Y |

This field enables you to choose which XML Output Group you want to use. The XML output groups are used to determine which elements are passed back to your calling application from Determination. Choices are all XML Output Groups owned by this company or any of its ancestors. For more information, see XML Output. |

|

TransEditor Group |

Y |

This field enables you to choose which TransEditor Group you want to use. TransEditors are used to modify incoming data to enable Determination to calculate tax based on your company's specific needs. Choices are all TransEditor Groups owned by this company or any of its ancestors. For more information see TransEditors. |

|

Product Qualifier Group |

N |

This field enables you to select which Product Qualifier Group you want to use. A product qualifier group belongs to a single company, which has a default product qualifier group. The default group is the preferred group. Product qualifiers enable you to specify custom attributes which, when evaluated together, drive the specific product to be used for a transaction line. Product qualifier groups enable you to specify categories that can be taxed according to use. All product qualifiers listed belong to the selected company. For more information, see Product Qualifiers. |

|

Tax Code Qualifier Group |

N |

This field allows you to select a defined Tax Code Qualifier Group. Available tax code qualifier groups are associated with the selected company. Tax Code Qualifiers enable you to create or modify ERP tax codes either based on one or more elements from the tax result (Dynamic) or with predetermined, free-form text (Static). For more information, see Tax Code Qualifiers. |

|

Allocation Group |

N |

This field enables you to choose which Allocation Group you want to use. Allocations enable you to split invoice lines into multiple logical lines, each with their own unique characteristics such as product code and address fields. Choices are all Allocation Groups owned by this company or any of its ancestors. For more information see Allocations. |