Authority Rate Sets

Menu > Tax Data > Authorities > Basic (Rules and Rates) > Rate Sets

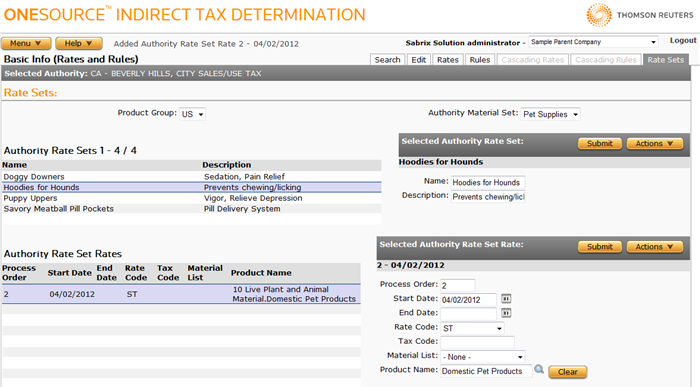

Use this page to specify Rates and Fees to associate with the products found in the Material Lists contained in the authority's Authority Material Sets.

You can configure multiple rate sets for each authority material set. Remember that only a single authority material set can be active on a specific date.

Each rate set contains a list of rules which map material lists or products to a previously configured rate code or fee for this authority. Rates are processed in rule order, which the first matching rate applied.

All rules in a rate set must be either rate calculations or fee calculations. You cannot mix rates and fees in a single rate set.

Before using this page for the first time, please review Material Sets (Product Group Taxability).

This page has the following areas and associated tasks:

- Rate Sets Selector: You select the Product Group and Authority Material Set whose Rate Sets you want to manage.

- Authority Rate Sets List: Select or view data about the rate sets currently associated with the selected Authority Material Set.

- Selected Authority Rate Set: Manage the selected rate set or add a new rate set.

- Authority Rate Set Rates List: Select or view data about the rates included in the rate list.

- Selected Authority Rate Set: Manage the selected rate or add a new rate.

- Associate a Rule or Cascading Rule to the rate set: For more information about associating a rule to the selected authority, see Rules.

Authority Rate Sets List Tasks

The Authority Rate Sets List is populated by all rate sets associated with the selected authority.

If you select a rate set from the list, the Selected Authority Rate Set section is populated with data related to that rate set.

Selected Authority Rate Set Tasks

You can use this section to either attach a rate set to an authority, modify data, or detach the selected rate set from the authority.

Add a new rate set

You can create a new rate set and attach it to an authority.

- Select Add from the Actions menu.

- Enter data using the field reference below.

- Click Submit to save your changes.

- Click the Rule tab or Cascading Rules tab to add an associated rule.

Modify a rate set

- Select the rate set from the Rate Sets List.

- Modify data using the field reference below.

Delete a rate set

You can delete a rate set which detaches it from an authority.

- Select the rate set from the Rate Sets List.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

Export a rate set

You can export the selected rate set or all rate sets associated with this material set.

This option is only available for Custom Rate Sets associated with Tax Data Provider authorities. To export a Rate Set associated with a Custom Authority, export the entire authority.

- Select Properties from the Actions menu.

- Click one of the following:

- This Authority Rate Set to export only the selected set.

- This Authority Rate Set and All Siblings to export all sets associated with the selected Authority Material Set.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

|

Authority Rate Sets List Field Reference |

|

|---|---|

| Field | Description |

|

Name |

The name of the rate set. Required. |

|

Description |

A description for this rate set. |

Authority Rate Set Rates List

The Authority Rate Set Rates List is populated by all rates associated with the selected rate set, in process order.

If you select a rate from the list, the Selected Authority Rate Set section is populated with data related to that rate.

Selected Authority Rate Set Tasks

Use this section to either manage the selected rate or add a new rate to the selected rate set.

Add a new rate

- Select Add from the Actions menu.

- Enter data using the field reference below.

- Click Submit to save your changes.

Modify a rate

- Select the rate from the Rate Set Rates List.

- Modify data using the field reference below.

Delete a rate

- Select the rate from the Rate Set Rates List.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

|

Authority Rate Set Rates List Field Reference |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Process Order |

Y |

A number representing the order in which this rate will be processed. The lowest number is processed first, and the lowest-numbered rate which matches the material list or product for the effective time period is applied to the transaction. |

|

Start Date |

Y |

The effective start date for this rate. |

|

End Date |

Opt. |

The effective end date for this rate. When left blank, the rate will not expire. |

|

Rate Code |

Y |

A configured authority Rate or Fee Code which specifies the actual rate to apply. Each rate set must contain either all rate-based rules or all fee-based rules. You cannot mix rates and fees in a rate set. |

|

Tax Code |

Opt. |

An optional tax code to match the Input XML passed in with the transaction, as well as any tax code listed on the calling rule.

Any tax code specified here matches values input at either the Invoice or Line Level. If you want to apply a Tax Code to only the Invoice or Line level, leave this field blank use a rule qualifier instead. See Rule Qualifiers. |

|

Material List |

Y |

The material list containing the products to associate with the rate set rate. The list of material lists consists of all lists found in the selected Authority Material Set. The default is None. A Material Set or Product Name, but not both, can be specified. |

|

Product Name |

Opt. |

A product to associate with the rate set rate. A product can be matched by any of the following means: direct match, parent product match, commodity code match, or parent commodity code match. To specify a product, either:

A Product Name or Material Set, but not both, can be specified. |