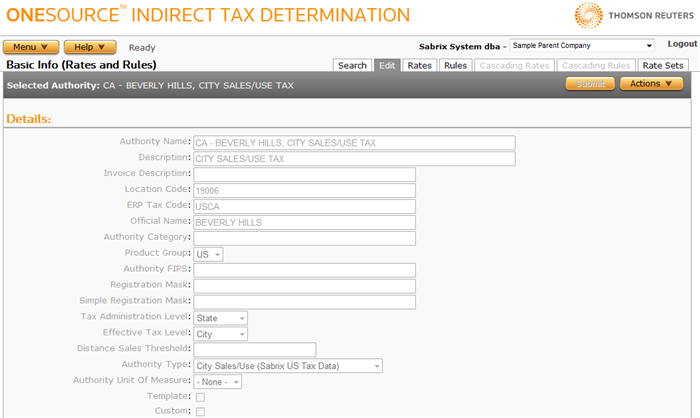

Edit Authorities

Menu > Tax Data > Authorities > Basic (Rules and Rates) > Edit

Use this page to view or update detailed information about the selected authority. You can only edit authorities owned by your company: a Tax Data Provider can modify the TDP authorities it owns, a Custom Data Provider can modify the custom authorities it owns, and for other companies, this page is view-only.

Use the Edit Authorities Field Reference below to enter data in required and optional fields.

This field can only be modified for custom authorities.

- Enter the authority details using the field reference below.

- Click Submit to save your changes.

Rename the selected authority (custom authorities only)

Modifying an authority name does not update any existing audit data for that authority. The authority will not be renamed in historical audit data.

- Enter a new Authority Name.

- Click OK to confirm that you want to modify the name.

Add a new authority

You can only add a Tax Data Provider.

- Select Add from the Actions menu.

- Enter the authority details.

- Click Submit to save your changes.

Add a new custom authority

You copy an existing authority and modify it to create a new custom authority. Use this procedure only if you have selected the desired template or custom authority.

You can only add a new Custom Data Provider. Use a unique name, (not shared by another authority, even if owned by a different Custom Data Provider or Tax Data Provider).

- If necessary, return to the Search Authorities page, and then search for and select the desired template or custom authority.

- Select Copy from the Actions menu.

- Enter a new authority name and click OK.

- Enter the authority details.

- Click Submit to save your changes.

- After you create the new authority from the copied authority, manually update or delete any data that does not apply to the new authority. When you copy an authority, you also copy all data associated it (such as rates, rate sets, rules, rule qualifiers, and rule output).

Delete the selected authority

You can only delete authorities your company owns.

- Select Delete from the Actions menu.

- Click OK to confirm the deletion.

Export a custom authority

You can export the selected custom authority or the custom authority and its siblings. In either case, rate, fee, rule, option, contributing authority, zone authority, and logic mapping data associated with the selected authorities are also exported.

- Select Properties from the Actions menu.

- Click one of the following:

- This Authority to export only the selected custom authority.

- This Authority and All Siblings to export the selected custom authority and all other custom authorities owned by this Custom Data Provider.

- Click Save.

- Browse to or enter a filename to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

|

Edit Authorities Field Reference |

||

|---|---|---|

|

Field |

Req? |

Description |

|

Authority Name |

Y |

The name of the authority you are editing. This field can only be modified for custom authorities. |

|

Description |

Opt. |

The description of the authority. |

|

Opt. |

The description of the authority returned with the invoice. |

|

|

Opt. |

An authority-defined code number for this location used by the authority to organize data. If this is not provided by the authority or by the tax data provider, do not enter a value in this field. Valid for US authorities only. |

|

|

Opt. |

A tax code that will be returned in the Output XML if present and if the Comment field for the selected Rules or Cascading Rules is blank. |

|

|

Official Name |

Opt. |

This field is populated when the official authority name required to be included on tax returns differs from the standard Determination-provided authority name as shown above. This field is populated by Determination for some authorities, but can also be used for your Custom Authorities if desired. |

|

Authority Category |

Opt. |

This field enables the summation, for tax return purposes, of authorities by category such as transit, water, or police district. This field is populated by Determination for some authorities, but can also be used for your Custom Authorities if desired. |

|

Y |

One of the six geographical product groups defined by Determination. |

|

|

Opt. |

This field is used by ONESOURCE Indirect Tax Research to store the FIPS (Federal Information Processing Standards) code associated with a US authority. If this field is blank or contains the string IN, the FIPS code has not yet been added to US Tax Data. |

|

|

Opt. |

A numeric code used to test whether registration numbers fit the basic criteria for a given authority. For more information, see Registration and License Formats and Registration Masks. Not used in the US by default. |

|

|

Opt. |

A numeric code used to test whether registration numbers fit the basic criteria for a given authority. For more information, see Registration and License Formats and Registration Masks. Not used in the US by default. |

|

|

Y |

Where the tax is actually administered. For example, many US states administer both state and county taxes. |

|

|

Y |

Where the tax logically applies. In the example above, where a US state administers both state and county taxes, the effective tax level defines who the tax is being collected for regardless of who is administering it. |

|

|

Opt. |

Applies to sales in which the buyer and seller are located in different EU countries. An amount of goods sales which, if exceeded in a year by a seller, will cause that seller to register with this authority. |

|

|

Authority Type |

Y |

A field used to organize data for audit and reporting purposes. Determination provides authority type mappings for all US and INTL Tax Data authorities. You can use this field to specify an Authority Type for use by a Custom Authority. You can also use the Authority Types page to create a new Authority Type if necessary to meet your needs. |

|

Authority Unit of Measure |

Opt. |

A default unit of measure for this authority. The default is None. If specified, Determination will select a quantity associated with this unit of measure if the following conditions are true:

For more information, see Units of Measure Conversion. |

|

Template |

NA |

Indicates whether or not this is a template authority from which other authorities can be created. This checkbox cannot be modified. |

|

Custom |

NA |

Indicates whether or not this is a custom authority. This checkbox cannot be modified. For more information, see Custom Authorities. |