Workbench Line Data

Menu > Workbench > Main

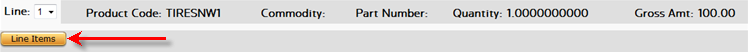

The Lines area of the Workbench has two modes: Line Items and Line Data. Click the button to toggle between the display modes.

On the Workbench Main page, basic Line Items is the default view. It shows line information for the selected scenario.

Click the Line Data button to modify data associated with the line. You can click the Line Items button to return to the basic lines display:

Line items are only shown when they offer different items than found in the Invoice section.

Line Items Mode

In the following procedures, use the field reference table for Line Items to enter data in required and optional fields.

|

Line Items Field Reference |

|

|---|---|

|

Description |

A description of a particular product. This data is used to retrieve and reference records from the audit data. |

|

Product Code |

A custom label mapped to a product in one of the Determination product trees. Typically, product codes match items or charges from your source system. For more information, see Products. |

|

Commodity Code (Commodity) |

A number that can be assigned to a product by a particular authority. In the EU, many member states have moved to using Harmonized Codes (similar to Commodity Codes) which can be stored in this field. For more information on how commodity codes are used, see Rules. When commodity codes are evaluated by the calculation engine, it first attempts to match the full code; then strips off characters from the end of the code, one at a time, until no code remains. |

|

Part Number |

The part number used by the referring application. This element is stored in the audit tables and does not affect calculation. The Workbench allows only 20 characters although the <PART_NUMBER> XML element allows 100 characters. |

|

Quantity |

The number of goods being supplied. This can affect calculation in certain Max Tax situations. If a quantity is not specified, Determination defaults to a quantity of one. |

|

Units |

A unit of measure associated with the specified quantity. The default is each. For more information, see View and Manage Units of Measure. |

|

Gross Amount (Gross Amt) |

The gross amount for the line. You can override this amount by specifying an Item Value on the Calc Options page. |

|

Effective Rate (Eff%) |

This read-only field shows the effective rate of tax for the line. It is updated each time you click the Submit button. |

|

Tax Amount (Tax Amt) |

This field shows the amount of tax for the line. It is normally read-only, and is updated each time you click the Submit button. In reverse calculations, the field is enabled for data entry. |

|

Total |

The total amount for the line (Tax Amt plus Gross Amt). |

Add a line (Line Items mode)

- Enter data on the blank line at the bottom of the list.

- Click the Submit button to save your changes.

Copy a line (Line Items mode)

- Click the line's Copy button.

- Click OK to confirm the copy. The new line appears beneath the copied line.

Delete a line (Line Items mode)

- Click the line's Delete button.

- Click OK to confirm the deletion.

Modify line basic information (Line Items mode)

- Modify data for the desired line.

- Click the Submit button to save your changes.

Line Data Mode

For procedures in Line Data mode, use the Line Data field reference below to enter data in required and optional fields.

Modify line details (Line Data mode)

- Load the page for which you want to add line-specific configuration, by clicking on the page's tab.

- Click the Line Data button in the Lines section.

- Choose the line number to edit by selecting it from the Line drop-down menu.

- Modify data for the desired line. For more information, see the help for the associated Workbench page.

- Click the Submit button to save your changes.

|

Line Data Field Reference |

|

|---|---|

|

Customer Name |

Matches relevant exemption certificates. Enter one of the following if desired:

This is an auto-complete field. You can begin typing the customer name, then press TAB and ENTER to complete the entry. Or, click Find to search from the list of customers in the active customer group. |

|

Customer Number |

An alternate method of specifying a customer. |

|

Delivery Terms |

One of the following:

Each item in the drop-down list indicates the description of the term as well as the owning company (in parentheses). System data is indicated by (System). A delivery term always overrides any specified point of title transfer for the transaction. See also the Point of Title Transfer field below and the help topic Point of Title Transfer for more information including a complete list of codes and descriptions. |

|

Point of Title Transfer |

Used in some transaction types and locations to determine the point of taxability. Valid choices are In Transit (default), Origin, and Destination. See also the Delivery Terms field above and Point of Title Transfer. |

|

Related Line Number |

Use this line when adding a related charge, such as freight, to this scenario. The related line number indicates the line with the parent product whose tax treatment is used by the related charge. For more information, see Dependent Product Taxability. |

|

Rule Unit of Measure |

Indicates a unit of measure as specified on the Rules or Cascading Rules page. |

|

Transaction Type |

The transaction type required to apply the correct type of taxes to the transaction. The default is Goods; for more information on valid types see Transaction Types. |

|

Vendor Name |

Entering a vendor here can affect B2B processing logic. Enter one of the following if desired:

You can click Find to search from the list of configured companies, or enter a company name directly. Do not use slashes or carat characters in a company name. |

|

Vendor Number |

An alternate method of specifying a vendor. |