Workbench Modeling and Testing

The ONESOURCE Indirect Tax Determination Workbench is a powerful tool that enables tax professionals and other users to:

- Create transaction scenarios to test configurations and model the impact of business and tax changes.

- View the input XML that would be needed to submit the transactions you model.

- View the output XML that would be generated by Determination once results are calculated.

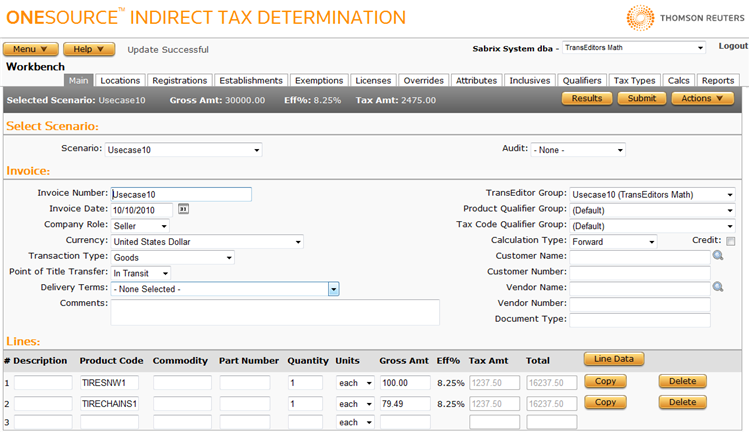

On the Workbench screens, you create and save scenarios that represent your business processes and configurations. As shown below, key areas include: Scenario name, Invoice data, Line information, Line data, and tabs.

Modeling a Basic Transaction

When creating a Workbench transaction, consider:

- Naming conventions: Create a name that effectively describes the transaction, such as WA - Sales Exemption for Machinery.

- Comments: Use the comments field to add descriptive text about the scenario to further describe the transaction you are modeling.

- Basic requirements: You need to enter at least a date, company role, quantity, gross amount, and ship-to address.

- Unique requirements: Add data such as customer name or number, registration data, and product data.

On the Workbench, you enter data at two levels: Invoice (or Header) data and Line data. By default, Invoice (or Header) data is used for all lines in a transaction. Line data can override Invoice data or can provide additional detail not available at the header.

In addition to the data you enter, the Workbench accesses stored data in the system to evaluate establishments, exemptions, registrations, and licenses.

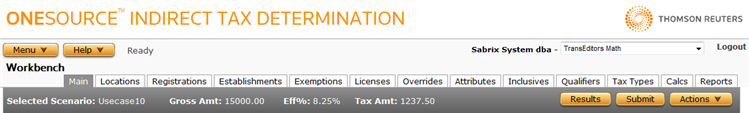

Once you submit a scenario, the results are immediately shown at the top of the page, as shown here. For detailed results, including line and authority level detail as well as all messages returned with the transaction, click Results. For more information, see Viewing Workbench Tax Calculation Details.

Viewing Input and Output XML

In many cases, you will want to view both the input and output XML generated by the Workbench.

-

Input XML is the XML that the Workbench generates, and can be used to help verify that your integration is passing in all of the necessary attributes to enable correct taxation. Input XML can be copied, modified, and used in the xmlinvoice servlet.

For more information, see The xmlinvoice Servlet.

- Output XML is the XML that would be returned by Determination if it calculated this transaction.

Modeling Advanced Transactions

As you gain experience using Determination, you may wish to model transactions that include any of the following data:

- TransEditors

- Allocations

- Multiple lines with different product codes, ship-to addresses, or other unique data

- Customer exemptions

- Registrations or licenses

When you calculate a scenario that uses TransEditors or allocations, you can view XML in XML Output, Filtered XML Input, or Allocated XML Input. These views may be useful when troubleshooting allocation and TransEditor behavior.

If you need assistance modeling scenarios in the Workbench, contact Customer Support.

For more information about using the Workbench, see: